As a billing company focused on holistic healthcare providers, we’ve introduced our share of acupuncturists to the world of acupuncture insurance billing codes.

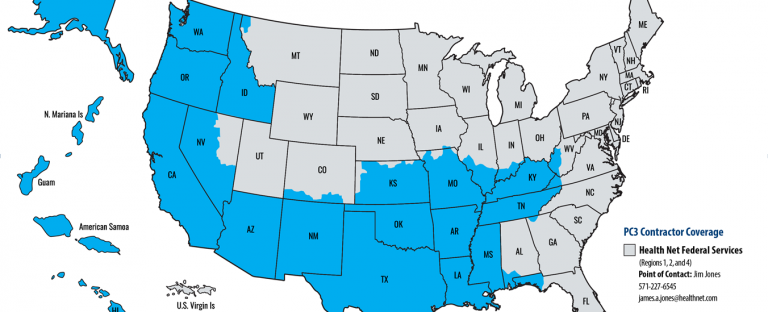

One of the most frequently asked questions by new and seasoned practitioners billing insurance for acupuncture. Due to the unique population, reimbursement rates and the preauthorization of patient visits most practitioners find participating in the VA’s Veterans Choice Program (VCP), and Patient-Centered Community Care (PC3) plans administered through TriWest to be highly rewarding.

The importance of accurate billing and optimized practice management can not be overstated. Often, the two go hand-in-hand, as your practice is at its best when the administrative and service sides of your business are delivering their best! One particular quality of this has to do with billing for massage therapy services. This blog covers some of the most common CPT codes you’ll need, as well as some frequently asked questions about how to bill insurance for massage therapy.

Why Does Accurate Massage Therapy Insurance Billing Matter?

Maintaining a clean claim rate of 95% or better for your massage therapy practice means your overall practice operates in a streamlined manner. Accurate billing is the result of using appropriate codes and filing claims in a timely manner, which means you’ll get reimbursed by insurance companies promptly and your revenue cycle doesn’t get too interrupted. Overall, accurate insurance billing can impact your practice’s financial standing!

Most Frequently Asked Questions About Massage Therapy Insurance Billing

Does Medical Insurance Cover Massage Therapy?

Not all insurance covers massage therapy, so it’s not guaranteed that your patient’s insurance will reimburse you. Be sure to discuss rates and payment expectations with your client during your initial phone contact. Getting things in order before their initial visit makes good sense in order to avoid time-consuming issues later on. Be sure to ask your client to find out whether massage therapy is a coverable service under their specific insurance and plan. If it is, they may want to check if massage is coverable by a massage therapist. Some plans require that massage be performed by a physical therapist.

In some cases of an auto accident and worker’s comp, it may also be necessary to be in regular contact with a case manager regarding your services as they may be assigned to oversee the care of their insured.

Does Medicare Cover Massage Therapy?

At present Medicare does not pay for massage treatments, but in general, there are three main sources of insurance billing for massage therapy, these may vary from state to state:

- Major medical plans (Blue Cross, Blue Shield, United, Aetna, Cigna, etc.)

- Personal Injury (PIP)

- Workers Compensation Insurance (Workers Comp)

It is important to note that it is not enough to just know the insurance vendor’s name; you also want to know the specific insurance plan, and the employer, to determine a patient’s insurance coverage. When you bill insurance for medical massage services, you will need to verify your patient‘s insurance benefits directly with the payer before you start treatments. You can do this by contacting the insurance company via the phone number listed on the patient’s medical card and providing the patient’s policy information along with their date of birth.

Can a Licensed Massage Therapist Bill Insurance?

Yes, as long as:

- The therapist is licensed,

- The services are prescribed as a necessary part of the medical treatment plan by an MD, DO, or chiropractor and,

- The therapist has a valid NPI number. If you don’t have an NPI number you can apply for one here: https://nppes.cms.hhs.gov/#/

Most Frequently Asked Questions About Massage Therapy CPT Codes

CPT stands for Current Procedural Terminology (CPT). The American Medical Association (AMA) manages the oversight of the codes that give definition and structure to the procedures and services performed by physicians and health care providers across the country.

We know that massage therapy CPT codes can be challenging; here are some of the most frequently asked questions:

What Are The Most Common CPT Codes for Massage Therapy?

The bulk of the services a licensed massage therapist bills to insurance will likely fall under the following codes:

- 97010 Hot and Cold Pack Therapy (Hydrotherapy)

- 97124 Massage Therapy (Basic Swedish Massage): Therapeutic Procedure, 15 minutes; one or more areas, including effleurage, petrissage, and tapotement, compression, percussion

- 97140 Manual Therapy (Advanced Massage Therapy Techniques): Therapeutic Procedure, 15 minutes; mobilization, manipulation, manual lymphatic drainage, manual traction, one or more regions

- Massage (97124) and manual (97140) therapies are broken down into 15-minute increments. Mixing and matching these codes can get your claim, or part of your claim rejected depending on the insurance company and the state. Therefore, we recommend you stick with one therapy per visit.

Here is an example of how to use the code for a 60-minute visit to massage therapy:

Use code 97010 one time per day. If a chiropractor, physical therapist, or doctor has already used this code, then you cannot, for this reason, we recommend you have your appointments set on different days from other providers.

What Are Common Mistakes with Massage Therapy CPT Codes?

Mixing Up CPT Codes

Codes 97124 and 97140 should not be used to bill for activities within the same session. Most of us could not distinguish when our therapist transitioned between the techniques used in 97124 to the techniques used in 97140 and vice versa.

97001 and 97002 are for physical therapy evaluation; these codes are for physical therapists and should not be used by massage therapists. Their use implies that the user is a physical therapist. 97112 is not the code for neuromuscular therapy; use 97140 instead.

Misusing Code Modifiers

- CPT Code Modifier – 59: The purpose of CPT code modifiers is to clarify the activity and intent of the therapist. An example would be modifier -59. This modifier is used to report Distinct Procedural Service. (Note that the use of the -59 modifier identifies two procedures of similar nature performed on the same individual within a single day or a few days. Using -59 modifier may raise flags with an insurance company and delay payment.)

- CPT Code Modifier – 52: CPT modifier -52 is for reduced services. Like -59, it is used to help explain what has taken place with one client. Its purpose is to identify and clarify the activities of the therapist. It is used to explain the time differential between two units of therapy, one of which is shorter than the other.

Using modifiers to justify increased fees to insurance companies is a misuse of those codes and damages the relationship between massage therapists, the medical community, and insurance companies. The use of CPT modifiers by massage therapists is seldom appropriate or necessary. The vast majority of us would keep to a schedule of full units, in which the use of modifiers would be for very unusual circumstances only.

What Are Ways to Avoid Delays and Denials with Massage Therapy Billing?

Ensure Your Practice Is Credentialed First

Before you can bill insurance for massage therapy services, your practice should be medically credentialed to bill as an in-network provider or enrolled to bill out-of-network. Credentialing is necessary for many commercial insurance companies, or government plans like Veterans Affairs. Typically, the process involves documentation and verifying all licenses, though the exact requirements vary on the insurance provider.

Before you can bill insurance for massage therapy services, your practice should be medically credentialed to bill as an in-network provider or enrolled to bill out-of-network. Credentialing is necessary for many commercial insurance companies, or government plans like Veterans Affairs. Typically, the process involves documentation and verifying all licenses, though the exact requirements vary on the insurance provider.

Confirm Your Patient’s Insurance Eligibility

A common problem with insurance billing is when claims are denied or delayed due to ineligible insurance coverage of established patients. Whether or not the patient declined to alert their healthcare provider about the insurance change or if the provider failed to update patient records, the result can be delayed payments. Confirming your patient’s insurance eligibility before their first visit can prevent issues with insurance companies. In our opinion, correct verifications have the most direct correlation with successfully getting claims paid.

Stay Up To Date With New Codes or Code Changes

CPT codes for massage therapy procedures can change through the years or entirely new ones can be created. Since codes can be revised and discarded, your holistic practice needs to stay aware of the most current information and make sure you’re not using any outdated codes that could cause issues with insurance billing.

Turn To The Experts for Your Massage Therapy Insurance Billing

While massage therapy has traditionally been a cash-based treatment in the United States, there is a growing trend towards practices accepting insurance. Expanding your business model by adding insurance billing for massage can increase your revenue while protecting your business from economic downturns.

Balancing your practice’s insurance enrollments, billing, and coding while delivering care to your patients can be overwhelming, but outsourcing your massage therapy insurance billing can save you time, energy, and streamline your revenue cycle management!

At Holistic Billing Services, we’ve helped thousands of practitioners and owners expand their practices by adding insurance billing for massage therapy. With an expert partner by your side, you can focus more on treating patients to help your practice grow rather than worrying about insurance billing. To learn more about our massage therapy billing services, talk to one of our billing and coding experts today.

The Veterans Choice program through the Department of Veterans Affairs (VA) enables you to care for veterans. Whenever a vet lives too far from a VA facility or the VA is unable to treat the vet within the next 30 days the patient is referred to community-based providers.

Holistic providers who are considering accepting insurance generally have plenty of questions surrounding the issue of whether to bill under the practice name or use a personal social security number. If you’re establishing your practice, you might be tempted to just use your SSN – however, there are numerous advantages to utilizing an Employer Identification Number (EIN) attached to your practice.

Ultimately, the decision to bill under your SSN or EIN should be addressed prior to treating patients, ideally, after consulting with an accountant or attorney as to which makes the best sense for you. Keep reading to learn more about the benefits of an EIN compared to an SSN for medical billing!

What is an EIN?

An Employer Identification Number (EIN) is something you may not have even heard of until recently, though it was an identification system established by the IRS in 1974. According to the IRS, “An employer identification number (EIN) is a nine-digit number assigned by the IRS. It’s used to identify the tax accounts of employers and certain others who have no employees.” If you don’t have employees, you aren’t required to get one – however, there are still valid reasons to do so, whether you plan to bring employees aboard or not.

Think of an EIN as a public social security number for your holistic practice. Similar to how each individual has a unique social security number, each business can have its own EIN. So if you’re the sole employee of your holistic practice, you can choose to use your social security number to identify your business. Nevertheless, there are some factors to consider before plastering your private, personal SSN on various business forms for your practice.

What are the Benefits of an EIN vs SSN?

When setting up the administrative side of your practice, it’s important to consider your options carefully. For example, comparing the benefits of utilizing an EIN instead of your personal SSN for medical billing might include the following points:

Using Your SSN for Medical Billing Puts You At Risk for Identity Theft

Applying for an EIN – which takes about 10 minutes – instead of using your private social security number will continue to keep this critical number safeguarded, reducing the risk of identity theft. Rather than broadcasting your personal SSN on various business forms, using your holistic practice’s EIN is more secure for your identity. It’s less likely for someone to break into your accounts when you keep business finances and personal finances separate. For example, If you’re a sole proprietor without an EIN, and you continue giving out your SSN to clients or vendors, you’re putting yourself at a higher risk.

An EIN Helps Establish Business Credit – and Benefits Your Finances

An EIN also means your practice is officially recognized as a legal entity. Therefore, you can start building credit for it! If you’re new to starting a holistic practice and unsure about how to build credit for your business, don’t worry. It’s essentially the same as establishing, managing, and utilizing your own consumer credit report information. In the same way you established your personal credit to apply for credit cards, mortgages, or even personal loans, your new practice needs to establish credit. In fact, most banks require an EIN in order to open a business banking account; this will simplify the process of tracking and managing your professional expenses, and, as a result, you’ll be able to make more efficient budgeting plans for your holistic practice. Plus – in the worst case scenario – if your practice files for bankruptcy, your personal assets are protected from business losses.

Another advantage to distinguishing your personal assets from your holistic practice’s deals with taxes; filing taxes on behalf of your holistic practice with an EIN separately from your personal accounts might result in tax benefits. Be sure to consult your tax professional to compare rates and see where your holistic practice’s EIN might come in handy with Uncle Sam.

Utilizing an EIN Aids the Hiring Process

If you’re starting your holistic practice and you’re its sole employee, it might be hard to imagine now — maybe your practice is just getting started, you like the pace, and you’re excited about going it alone — but you may want to hire additional employees sometime in the future. And when you do, you will absolutely need an EIN. It’s a requirement by the IRS for taxation purposes, plus you’ll need it for any payroll systems you set up. An EIN is a small thing now that can make a big difference and help reduce headaches in the future of your holistic practice!

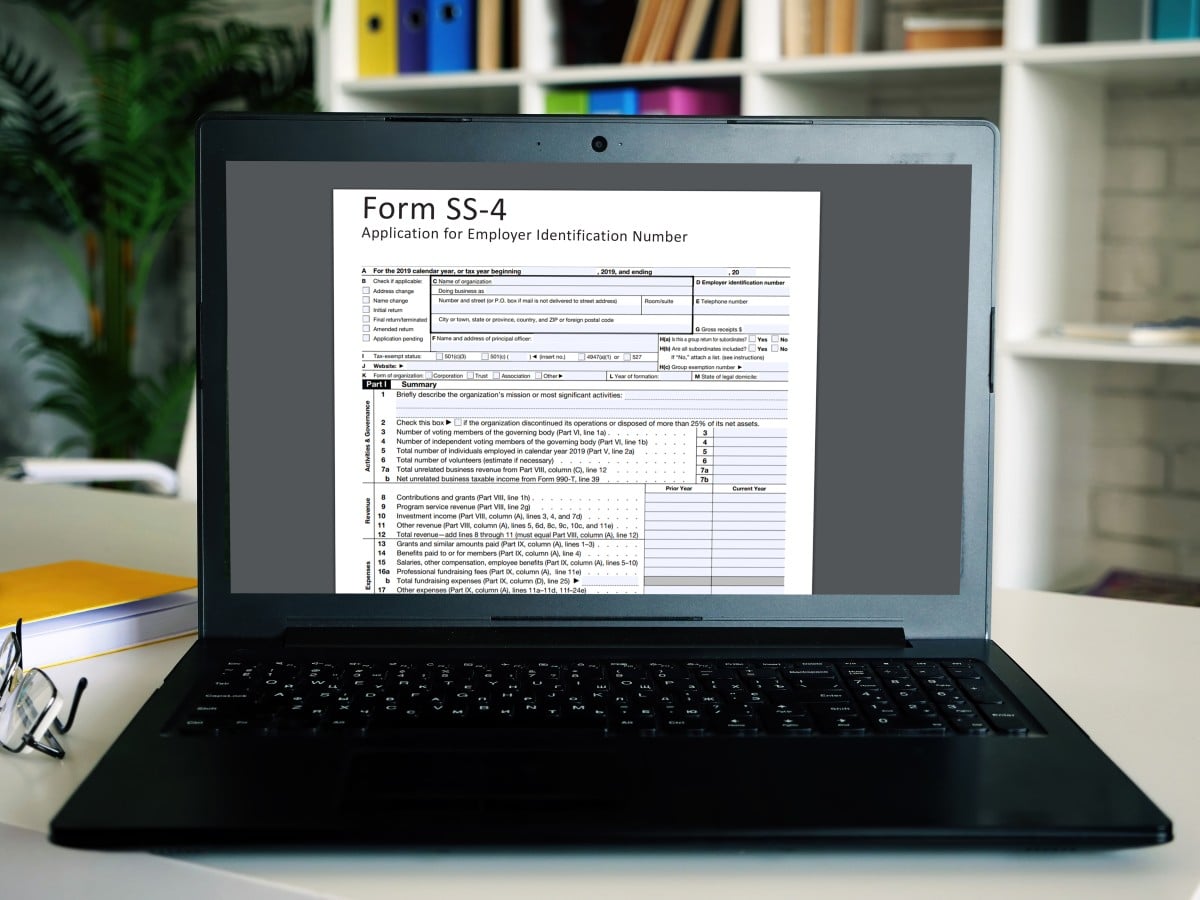

How To Get an Employee Identification Number (EIN)

It might be uncommon to hear a government form described as simple or easy, but we promise applying for an EIN is just that! This process takes less than 10 minutes, it’s free, and it can really impact the administrative aspects of your holistic practice.

It might be uncommon to hear a government form described as simple or easy, but we promise applying for an EIN is just that! This process takes less than 10 minutes, it’s free, and it can really impact the administrative aspects of your holistic practice.

Here’s how to do it:

1. Grab your laptop and visit the IRS’s online EIN Assistant page.

2. Follow the EIN Assistant’s instructions and submit the information requested.

3. After your application is submitted, you’ll get your EIN immediately.

4. Be sure to write this number down somewhere safe so you always have it handy.

That was easy! We here at Holistic Billing Services know it takes a lot to run a streamlined and effective practice. Serving your patients and treating them with the best holistic approaches should always be your top priority, but sometimes massive piles of paperwork, billing errors, and insurance delays can weigh you down and poorly affect your practice.

Our experts here at HBS believe that your success is our success. From handling medical billing and coding to offering consulting services and much more, our team is dedicated to making it feel like we’re in-house. With a focus on holistic practices, insurance background, and proven consultants, our team can work with you regarding all holistic practice-related matters, and even help you navigate legal complexities like non-compete agreements. Contact us today!

By now, I hope you have heard that ICD-10 diagnoses will be required for billing insurance for acupuncture come October 1, 2015. Here is a closer look at some frequently asked questions.

When billing insurance for acupuncture many providers miss out on significant reimbursements by not billing evaluation and management codes (E&M). In many states acupuncturists are eligible to bill for E&M codes. As an acupuncture billing company we come across far too many providers not billing E&Ms due to a lack of understanding of the codes and how they are used in acupuncture billing.

Are you struggling with billing insurances? It may be a smart decision to outsource your insurance billing to an experienced acupuncture billing company. But the billing service you select will become more than just a services vendor—they‘ll become a partner in your financial success.

Have you thought about utilizing acupuncture insurance billing services? If you haven‘t or think it is too much work, you should reconsider!

Here are three benefits of accepting insurance for your acupuncture practice.