One of the quickest ways to ensure your healthcare revenue cycle is running smoothly is to utilize the most current medical billing codes for your practice. If you code for the wrong treatment, over or under code for services rendered, or submit your claims late, then you run the risk of delayed payment and a host of other issues.

If your holistic practice offers massage therapy treatments, then you’ll want to keep this list of massage therapy CPT codes and tips handy! Be sure to bookmark this page for easy reference so that you can enjoy a streamlined medical billing process.

Essential Massage Therapy CPT Codes

Some of the most commonly used CPT codes used by massage therapists are below:

- 97124 (Massage therapy): Describes work including effleurage, petrissage, and/or tapotement (stroking, compression, percussion) for every 15 minutes

- 97140 (Manual therapy): Includes therapy techniques, consisting of but not limited to connective tissue massage, joint mobilization and manipulation, manual traction, passive range of motion, soft tissue mobilization and manipulation, and therapeutic massage for every 15 minutes

- 97112 (Neuromuscular re-education): Entails the re-education of movement, balance, coordination, kinesthetic sense, posture, and proprioception in 15-minute intervals; examples include PNF (proprioceptive neuromuscular facilitation), Feldenkreis, Bobath, BAP’s Boards, and de-sensitization methods

- 97010 (Hot/cold packs): describes the application of moist heat or cryotherapy for relaxing muscle spasticity, promotion of vasodilation, increasing lymph flow, or other situations

- 97110 (Therapeutic exercise): use this code for therapeutic exercises applied to a single or multiple body parts to develop strength, endurance, range of motion, and flexibility within 15-minute intervals

Essential Modifiers for Massage Therapy CPT Codes

Sometimes it’s not enough to use the baseline massage therapy CPT codes – in which case, you’ll likely need to refer to these code modifiers:

- Modifier 59: This modifier for massage therapy CPT codes indicates that two separate but similar procedures were performed on the client within the same day or time span of a few days

- Modifier 52: Use this modifier if billing for a procedure that used a reduced modality as the provider saw fit

Billing Medicare: Timed vs. Untimed Massage Therapy CPT Codes

If your practice accepts patients who are covered by Medicare, then you’ll need to be mindful of the difference between billing for time or untimed massage therapy services.

Billing Medicare for Untimed Massage Therapy

When you choose to bill for untimed massage therapy services, you can only bill for one whole service. This means that no matter how much time you spend with your client, you’re only billing for one treatment as a whole.

Billing Medicare for Timed Massage Therapy Treatment

On the other hand, if you’re billing Medicare for a timed massage therapy treatment, then you get reimbursed based on the time spent 1:1 with the patient providing treatment. These timed codes can be billed multiple times per session.

Each code equates to 15 minutes of treatment; however, if the time spent with your client doesn’t result in an even amount of time divisible by 15, then you’ll use the 8-minute rule. Basically, after dividing the time of the session by 15, if the remainder you have is greater than 8 then you can round up and bill for an additional unit. If the remainder is 7 or less, then you’ll bill for the minimum number of units.

Here’s a handy table for referencing the 8-Minute Rule:

- 8-22 minutes: 1 Unit

- 23-37 minutes: 2 Units

- 38-52 minutes: 3 Units

- 53-67 minutes: 4 Units

Medical Billing Tips for Your Massage Therapy Practice

Keeping your healthcare revenue cycle in good health is no small feat; check out these tips for medical billing success:

First, Ensure Your Practice Is Appropriately Credentialed

Before you can bill insurance companies or government programs for your massage therapy services, your practice should be medically credentialed to bill as an in-network provider or enrolled to bill out-of-network. Credentialing is necessary for many commercial insurance companies, or government plans like Veterans Affairs. Typically, the process involves documentation and verifying all licenses, though the exact requirements differ from provider to provider.

Confirm Your Patient’s Insurance Eligibility Ahead of Time

A frequent problem when going through the medical billing process is when claims are denied or need to be reworked as a result of ineligible patient coverage information. Whether the patient is wholly ineligible for the services rendered or their information changed without being updated, this can result in delayed payments and the need to rework the claim. Be sure to confirm your patient’s information every time they come into your practice!

Be Careful to Avoid Overcoding

Due to the complexity of massage therapy insurance billing, overcoding is a common mistake. It’s important to be aware of the rules associated with all the massage therapy CPT codes to avoid delays.

For instance, you can only bill either one of codes 97140 or 97124; you won’t be able to bill for both. Likewise, CPT code 97010 for hot/cold packs is now mostly “bundled” with codes 97124 or 97140. This means you might not be able to bill a separate fee for this service.

Transform Your Medical Billing Processes With HBS!

Balancing your practice’s online appointments, SOAP notes, billing and coding while delivering care to your patients can be overwhelming but outsourcing your massage therapy insurance billing can save you time, energy, and optimize your revenue cycle management!

As an experienced EMR and insurance billing provider for holistic practices, Holistic Billing Services can help your practice navigate the insurance billing process to minimize denials and increase revenue. With a knowledgeable partner by your side, you can focus more on treating patients to help your practice grow rather than worrying about insurance billing.

To learn more about our massage therapy billing services, talk to one of our billing and coding experts today.

Your holistic practice’s longevity and financial success depends on how efficiently and effectively you can manage your revenue cycle.

Without ensuring this key component of your strategy is running smoothly, you’ll be struggling to keep your practice in the green.

A comprehensive revenue cycle management strategy can really transform your holistic practice and help chart the course of your practice’s future. But what exactly is a revenue cycle and how do terms like accounting or medical billing factor in?

We’ll break it down in this article; keep reading to learn more!

What Is Revenue Cycle Management?

In the most general definition, revenue cycle management, sometimes shortened to RCM, encompasses the identification, collection, and management of a practice’s finances based on the services rendered.

In other words, RCM refers to the processes required to manage and streamline the various components of a holistic practice’s financial standing.

The typical steps of a practice’s revenue cycle are as follows:

- Patient registration and scheduling

- Prior authorizations and eligibility verification

- Patient visit and treatment

- Documentation

- Charge capture and charge entry

- Medical coding

- Medical claim submission

- Payment posting or denial

- If claims are rejected, rework and resubmit until you get the money owed

A frequently asked question regarding RCM: who exactly is involved in the revenue cycle at your holistic practice? The short answer is everyone!

This includes your

- Patients

- Payers, whether it’s insurance companies or government programs

- Staff

Anything to do with the financial side of your holistic practice is, obviously, vital for its long-term presence in your community and your ability to scale up in the future.

For instance, effectively managing rejected claims and establishing processes that address errors in your claims is a foundational step to optimizing your overall revenue cycle management strategy.

What’s the Difference Between Medical Billing and Healthcare Accounting?

Since there are so many facets of the healthcare revenue cycle, it’s easy to use other financial terms interchangeably. Take medical billing and accounting—what do these two concepts actually mean and how do they relate to your holistic practice’s RCM?

Let’s break them down here:

Medical Billing

Medical billing is the process of translating a patient’s delivery of care into a financial representation so that your practice can be reimbursed for services rendered.

This process involves medical billing codes and submitting claims to insurance companies, Medicare, the VA, or whatever other payer programs relevant to your patients, so that you can receive money from them for the services you provided.

Healthcare Accounting

On the flipside, healthcare accounting is the practice of processing and recording financial transactions; basically, what you do in your personal finances but perhaps with a few more figures thrown into the mix.

Healthcare accounting includes a few different standards for performance, such as accounts receivable and accounts payable, which are two metrics that are vital to benchmarking your holistic practice’s financial health.

Effective Revenue Cycle Management Depends on Accurate Medical Billing

As the old adage goes, time is money. Nowhere is that truer than in the case of your holistic practice’s revenue cycle! Ensuring your medical billing process is streamlined and as accurate as possible might take some time and effort to establish but will bring tremendous benefits to your practice.

A streamlined medical billing and coding process means you’re only working each of your claims once and submitting them promptly so that you can get paid in a timely manner! Reworking claims happens to the best of us, but should be the exception, not the rule.

The sooner you can minimize bottlenecks and clunky medical billing processes, the better off your practice will be!

Partner with Holistic Billing Services to Optimize Your Revenue Cycle!

Partnering with a medical billing firm to handle your medical billing can radically transform your holistic practice’s revenue cycle.

A trusted firm can empower your practice with comprehensive reporting and can act as an in-house expert for all your revenue cycle needs. With the medical billing burden off your shoulders, you can focus on what matters most: delivering quality care to your patients.

With the friendly experts at Holistic Billing Services, you’ll have decades of experience by your side who can help navigate the worlds of medical billing, healthcare software, and more! Ready to optimize your revenue cycle?

About 1 in 4 medical students in America is studying to earn their doctor of osteopathy degree, which is comparable to a traditional MD degree. The school of medicine educating the next generation of DO’s has a long history of more than 100 years and, in fact, has a few parallels to the school of chiropractic medicine.

The next time you’re back pain flares up, would you go to an osteopath or a chiropractor? Let’s compare Osteopaths vs Chiropractors: we will dig into what these two lines of medicine are, their histories, and where they differ.

What Is Osteopathy?

Osteopathy is a branch of medicine in the US that focuses on full-body holistic health and wellness by emphasizing how the body’s systems are connected and need to work together in order to maintain health.

Similar to an MD, a doctor of osteopathy—known as a DO—attends medical school and is a fully-licensed physician who can specialize in any area, perform surgeries, work in pediatrics, emergency medicine, and more.

History of Osteopathy

Osteopathy was founded in America by Dr. Andrew Taylor Still, a physician who didn’t agree with the contemporaneous practices of bloodletting, blistering, treatments with mercury, etc. He believed that most ailments could be treated without the use of drugs; this curiosity, grounded in Still’s anatomical studies, lead to him exploring how medical conditions could be treated with a more natural healing process.

Eventually, Dr. Still would open the first osteopathic medical practice and found the first school of osteopathic medicine; here’s a brief timeline of the development of this medical thought from founding to the present day:

- 1826: Andrew Taylor Still is born, the third of nine children to Abram and Martha Still

- 1853: Still becomes a physician, studying closely with his father who was a preacher and physician

- 1861: Still enlists to serve as a physician during the Civil War for the Union state of Kansas

- 1892: The first osteopathic medical school, the American School of Osteopathy, opens in Kirksville, Missouri

- 1897: The American Osteopathic Association (AOA) is founded

- 1929: Pharmacology and surgical education is added to the osteopathic curriculum

- 1957: The US Department of Education recognizes the AOA as an accrediting organization for osteopathic medical education

- 1973: Doctors of Osteopathic medicine are certified in all 50 states and DC

- 2007: Osteopathic medicine is recognized in 45 countries around the world

- 2020: Osteopathic accreditation programs merged into one single accreditation program, further affirming osteopathic medicine’s standing in American healthcare education practices

History of Chiropractic Medicine

The word “chiropractic” derives from the Greek words cheir, meaning “hand”, and praktos, meaning “done”, in essence, “done by hand”. While manual wellness treatments have traditions spanning millennia, the particular profession of chiropractic medicine didn’t take shape until the late 1800s in America.

The birth of chiropractic medicine as we know it today is attributed to Daniel David Palmer, who had a background in magnetic healing and phrenology, or the study of diagnosing illnesses by the bumps on a person’s skull. Due to his dubious attitude toward traditional medical practices in his time, Palmer began experimenting on treating ailments through the manipulation of the spine.

Akin to Still and the birth of osteopathic medicine, Palmer believed that the human body was one organism that needed all parts to function properly for good health; Palmer felt that the origin of good health lay in the spine.

Let’s look at a brief timeline of how chiropractic medicine has developed over the last hundred years:

- 1845: Chiropractic founder Daniel David Palmer is born in Canada and later immigrates to the United States with his family in 1865

- 1895: While working in an office practicing magnetic healing, the building’s janitor, a man named Harvey Lillard, receives the first chiropractic adjustment; Lillard had been partially deaf for almost 20 years and Palmer noticed one of his vertebrae was out of place. After correcting the position of his vertebrae, Lillard reports that his hearing significantly improved

- 1897: Palmer opens the first school of chiropractic medicine, named Palmer School of Chiropractic

- 1913: The first law regarding the licensing of chiropractors is passed and thus makes chiropractic treatment officially legal

- 1964: The Palmer School of Chiropractic is renamed the Palmer College of Chiropractic and made a non-profit institution, thus greatly expanding its campus and student presence

- 1993: Congress passes legislation that includes chiropractic medicine in the US Department of Defense healthcare system

- 2014: The VA launched a chiropractic residency program, the first of its kind in the country, where chiropractors train alongside their medical counterparts at VA medical systems around the country

Osteopath vs Chiropractor: What’s the Difference?

Now that we’ve explored how osteopathic medicine shares some parallels with chiropractic medicine over the course of each practice’s history, let’s flesh out a couple of their differences, particularly in terms of training and treatment intentions.

Training and Education

To be clear, both osteopathy and chiropractic medicines require specialized training and education.

Although not medical doctors, chiropractors require at least 7 years of specialized schooling, credentials, and a state license in order to practice and become a Doctor of Chiropractic Medicine. Chiropractors cannot write prescriptions or perform surgeries, unlike those who hold Doctor of Osteopathy degrees; DO school requires several years of medical school and residency experience.

Intended Treatments

Visiting a chiropractor is probably your best method of treatment for alleviating pain caused by a car accident or a fall, especially if the pain is located in your lower back. Same if you find yourself waking up with pain or discomfort after sleeping in the wrong position or if you suffer from chronic back pain, leg pain, or neck pain.

On the other hand, an osteopathic medicine route is best for holistic ailments ranging from infertility, digestive problems, the common cold, and more. Basically, anything you would see a traditional MD for, an osteopath can just as well treat you. Plus, due to their holistic approach to comprehensive medicine, a DO can refer you to a chiropractor when needed.

Partner with HBS to Streamline Your Holistic Practice!

With decades of experience dealing with a broad range of medical billing issues for all kinds of holistic practices, the team at HBS has seen just about every kind of medical billing mistake that an organization can make. That’s why our clients trust us to help them manage their insurance claims to ensure they’ll be accepted as clean claims on the first attempt, avoiding lengthy back and forth negotiations with the insurance company. And best of all, you’ll avoid the scrutiny of federal and state auditors.

Contact us today to learn about Holistic Billing Services medical insurance billing services and find out how we can help you maximize your revenue!

One vital component for your holistic practice’s success is maintaining HIPAA compliance because it protects patient information, secures your operations, and prevents the chance of a breach that can greatly impact your practice’s reputation. We’ve compiled this comprehensive HIPAA cheat sheet to help you further understand this important legislation and how it pertains to your holistic practice.

History of HIPAA

The Health Insurance Portability and Accountability Act was signed into law on August 21, 1996. This vital piece of legislation created national standards to protect sensitive information regarding patient health from being shared or disclosed without the patient’s knowledge or consent. Basically, HIPAA prevents personal health information (PHI) from being discussed without the patient’s awareness and fortifies a patient’s privacy.

In addition to securing patient privacy and health information, HIPAA legislation aimed to prevent fraud and waste while also promoting medical saving opportunities across the healthcare industry as a whole. For example, certain tax breaks were established in this Act.

In 2009, the Health Information Technology for Economic and Clinical Health Act (HITECH) was passed, which establishes technological compliance requirements in alignment with HIPAA practices. This Act encourages the implementation of electronic health records to secure patient information and features the Breach Notification Rule stating that breaches exceeding 500 individual records must be reported to the Department of Health and Human Services’ Office for Civil Rights (OCR).

The latest legislation related to HIPAA was the Final Omnibus Rule, approved in 2013. The purpose of this Rule is primarily to refine HIPAA definitions and include compliance requirements for new pieces of technology, such as mobile devices.

Why Is HIPAA Important for Your Holistic Practice?

Besides protecting your patients’ information and safeguarding their privacy, HIPAA provides some administrative benefits to your holistic practice. Encouraging the transition from paper to electronic health records streamlines your practice and allows for more collaboration with other providers pertinent to your patients. Plus, all HIPAA-covered entities must utilize the same set of codes, so communication from one practice to another organization is further streamlined for efficiency.

Your HIPAA Cheat Sheet

Let’s break down some of the most essential components of HIPAA for your holistic practice’s reference:

PHI and ePHI

Personal health information, known as PHI, can take on a variety of forms that are all relevant to following HIPAA compliance. Here are the 18 types of information that are considered protected health information (PHI) under HIPAA:

- Name

- Address (Including any information more localized than state)

- Any dates (except years) related to the individual, including birthdays, date of death, date of admission/discharge, etc.

- Telephone Number

- Fax Number

- Email address

- Social Security number

- Medical record number

- Health plan beneficiary number

- Account number

- Certificate/license number

- Vehicle identifiers, serial numbers, license plate numbers

- Device identifiers/serial numbers

- Web URLs

- IP address

- Biometric identifiers such as fingerprints or voiceprints

- Full-face photos

- Any other unique identifying numbers, characteristics, or codes

ePHI, or electronic personal health information, simply refers to PHI that is transferred, accessed, or stored electronically. The same protections apply across PHI and ePHI.

Who Needs To Follow HIPAA Compliance?

Since PHI can be present in a variety of fields and formats, there are multiple types of individuals and organizations who must comply with HIPAA guidelines as they come across it, including:

- Healthcare providers: This is obvious, but it’s worth noting—healthcare professionals can have access to a plethora of patient information, so it’s crucial that they maintain HIPAA confidentiality when handling this sensitive data

- Health plans: Whether privately run or publicly operated programs like Medicare, health insurance-related agencies and their staff must adhere to HIPAA regulations

- Healthcare clearinghouses: These companies act as a kind of go-between for processing sensitive information and still need to maintain HIPAA standards

- Business associates: This covers the overarching third-party vendors or other businesses who interact with PHI for a variety of reasons

The ultimate aim of HIPAA legislation is to protect sensitive patient information across all platforms, so it’s vital that all parties follow HIPAA regulations when applicable.

Privacy Rule

The Privacy Rule essentially dictates that sensitive information is only used or disclosed with appropriate safeguards in place. It also stipulates that patients have rights to access their personal health information, obtain a copy of their records, authorize the communication of their records, and more.

The Privacy Rule is located at 45 CFR Part 160 and Subparts A and E of Part 164

Security Rule

Proposed in 1998 by the Department of Health and Human Services, and later ratified in 2003, the Security Rule sought to improve the security of a person’s health information that is shared between authorized parties, such as healthcare providers, health plans, and other pertinent organizations.

The Security Rule is located at 45 CFR Part 160 and Subparts A and C of Part 164.

Breach Notification Rule

The Breach Notification Rule was officially adopted in September 2009 and stipulates that any breach of electronic personal health information exceeding 500 individual records must be reported to the OCR and that each individual must be alerted to the breach, as well.

A breach is defined in HIPAA section 164.402 as:

“The acquisition, access, use, or disclosure of protected health information in a manner not permitted which compromises the security or privacy of the protected health information.”

When a breach occurs, the business or organization affected must determine the severity by considering what type of information was involved, who potentially saw this information, and evaluate the risk of the incident. From there, the organization can proceed with either patient notification—if the incident qualifies as a breach—or further risk mitigation.

There are also three exclusions to what counts as a breach:

- If the exposure was unintentional and is not expected to be a repeated offense

- If it was an accidental exposure from one HIPAA-certified person to another HIPAA-certified person

- If the covered entity—or organization—has reason to believe the unauthorized person wouldn’t be able to retain details of the personal information

Omnibus Rule

The Omnibus Rule is the latest piece of legislation to be associated with HIPAA. Taking effect in 2013, this Rule updates some definitions contained within the original act and expands the liability of businesses for not being HIPAA compliant. It also further protects patient information since it requires businesses to adhere to the Privacy and Security Rules which strengthen security measures when handling PHI and ePHI.

Maintain HIPAA Compliance with HBS

The experts here at Holistic Billing Services are HIPAA certified to handle your patients’ personal health information while streamlining your overall revenue cycle with excellent medical billing and coding processing. Your success is our success, and we offer a range of services to partner with your holistic practice including medical billing, consultation services, and more!

Our expertise is rooted in professional, technical, and global billing for hospital and stand-alone holistic care practices. To learn more about how outsourced medical billing with Holistic Billing Services can empower your practice, contact us today. We’ll work with you to build a customized solution that meets the specific needs of your practice and allows you to get back to treating patients.

How committed is your team to make your acupuncture practice the best it can be? From your medical billing department to your clinical staff to your front desk reps, everyone involved in day-to-day business around your holistic practice should be motivated to help you become a top-of-the-line medical establishment.

In order to understand how well your acupuncture practice is financially operating, you need to understand which metrics to track. Knowing which key performance indicators to monitor will empower your staff to optimize their work and streamline your acupuncture practice’s overall operations.

Why Does Efficient Acupuncture Billing Matter?

If your holistic practice’s billing staff isn’t diligent with billing practices, mistakes such as upcoding, downcoding, and inaccurate information can go undetected until it’s too late. This can lead to a high number of rejected claims and ultimately impact your practice’s financial future. Ensuring accurate billing and coding can protect your holistic practice from fines and inefficient billing practices that puts your practice at risk.

Every claim that is not paid on the first submission wastes your holistic practice’s valuable time and money. The Medical Group Management Association (MGMA) estimates that the average cost to re-work a claim that has been rejected or denied is $25 for each claim. If your integrative healthcare practice has to rework 100 claims per month, then it costs your practice an average of $2,500 a month to work on unclean claims; that’s an estimated $30,000 a year!

Additionally, inaccurately submitted claims can result in legal trouble. If your holistic practice submits too many improperly filled out claims, you can be flagged for potential fraud and abuse. The U.S. Department of Justice (DOJ) enforces laws, such as the False Claims Act and Anti-Kickback Statute, to crack down on coding abuse like improperly used modifiers, overcharged services, and more. In fact, fraudulent claims can cost your holistic practice thousands of dollars in fines!

Essential Metrics to Watch for Acupuncture Billing

As the saying goes, knowledge is power. In order to know how well your acupuncture practice is performing, you should investigate the following key performance indicators:

Net Collection Rate

When thinking about your revenue, you may be inclined to focus on gross collection rate – the total of your initial charges before adjustments. But your net collection rate is a better measurement of financial performance and collections effectiveness since it factors in the percentage (after negotiated contract write-offs) of collectible funds that are actually collected by your practice.

A 96% net collection rate is considered ideal across the industry. Anything lower than a 95% clean claims ratio means your holistic practice is losing revenue, which also indicates your holistic practice is wasting further money and time reworking rejected claims. In reality, most holistic practices have a rate that varies between 75% and 85%, which means that somewhere around 15–25% of claims submitted each month have to be worked on twice, at minimum.

Clean Claims Rate

Your holistic practice’s clean claim ratio is the average number of claims paid upon the first submission. Every provider would love to reach a percentage above 95, but it’s about more than just reaching that number – it’s about streamlining your practice!

Holistic practice budgets are tight, and your staff’s time is the most precious resource you have. So if your clean claims rate is less than 85%, it means your staff is likely having to spend extra time on identifying denial reasons, coordinating with payers, and re-submitting claims. Overall, the clean claims rate directly affects your holistic practice’s overall revenue cycle.

Holistic practices should strive for a 95% clean claims rate, however, few practices actually reach that target goal. Most practices receive reimbursements the first time a claim is submitted for approximately 75% to 85% of claims they bill, which means about one-quarter of claims are denied or delayed due to errors or incomplete documentation.

Accounts Receivable (A/R)

Accounts receivable (AR) is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Accounts receivables are listed on the balance sheet as a current asset. AR is any amount of money owed by customers for purchases made on credit.

Days Sales Outstanding (DSO)

This is probably one of the most critical pieces of information you need to obtain in order to run your acupuncture practice; this metric helps you budget your inflow and expenses. This is calculated by taking your A/R at the end of the closed month and dividing it by the charges at the end of the same closed month. You then take that number and multiply it by the calendar days in the same month.

Patient Balance

As with your entire payer mix, like insurance contracts, there should never be a high accounts receivable balance in any given class or insurance type. It’s really a good idea to not carry patient balances on your books for more than 90 days. If you have patient balances over this timeframe, find out why and work to resolve them as soon as possible.

Average Charge Per Visit & Pay Per Visit

Monitoring this self-explanatory metric also helps you keep track of underperformers at your practice. The average charge per visit and pay per visit are great pieces of information to have to set a standard; then, if you fall below this average on any given visit, it’s a good idea to investigate why.

Boost Your Acupuncture Billing Cycle with HBS!

By using these tips to boost your acupuncture practice’s revenue cycle, you’re sure to make the most of your practice’s revenue in the future. However, these tips definitely require time and effort to do it successfully. If you’re in need of expert medical billing services, let Holistic Billing Services be your go-to source for an error-free billing solution.

With decades of experience dealing with a broad range of medical billing issues for all kinds of holistic practices, the team at HBS has seen just about every kind of medical billing error an organization can make. That’s why our clients trust us to help them manage their insurance claims to ensure they’ll be accepted as clean claims on the first attempt, avoiding lengthy back and forth negotiations with the insurance company. And best of all, you’ll avoid the scrutiny of federal and state auditors.

Contact us today to learn about Holistic Billing Services medical insurance billing services and find out how we can help you increase your clean claims rate!

Like millions of people, watching a lot of fictionalized law shows on TV might leave you with the impression that you fully grasp various facets of the legal system and its regulations. In reality, laws and regulations can vary wildly between states, and it’s important to recognize that there are guaranteed to be far more complications than what might be explained in a crime drama. One such example is non-compete agreements, which sound pretty straightforward but can be handled differently across the country. This blog outlines what non-compete agreements are, how they’re enforced, in which states they’re illegal, and much more.

What is a Non-Compete Agreement?

A non-compete agreement is a contract that prohibits an employee from working for or becoming a competitor for a certain period. These arrangements are enforced when a relationship between an employer and employee ends, and the employer wishes to prevent the employee from competing against them in their next position, whether working for a competitor in the same market or starting up another business in the same field.

Non-compete clauses usually contain language that limits you from engaging in competition with your employer. In the healthcare industry, for example, these provisions often preclude you from practicing within a specific distance surrounding the practice and for a specified period. Under most state laws, a practice can enforce a non-compete agreement if it meets the following criteria:

- protects the practice’s legitimate business interest

- is specific in geographical scope

- has a narrowly tailored durational scope

How an Employee Non-Compete Agreement Works

Non-compete agreements overall should be both fair and equitable for all parties. They require certain information to be considered enforceable, including:

- An effective date on which the agreement will begin

- A reason for enacting the agreement

- Specific dates during which the employee will be barred from working in a competitive sense and the location covered by the agreement

- Details as to how the non-competing party will be compensated for agreeing to the terms

If your employer’s practice has more than one location, then you may be restricted within a radius from each location under your contract, even if you’ve never been to that particular location. If the language in the clause is vague or does not clearly describe the exact terms of your restrictions, the clause might be unenforceable or open to greater interpretation than either party anticipated. This is why having an attorney review your employment contract prior to signing is recommended since non-competes will greatly limit where – and when – you practice.

Which States Allow Non-Compete Agreements?

A majority of states do allow and enforce non-compete agreements, but several have specific exemptions. For example, Arizona exempts broadcasters; Florida exempts mediators; Vermont exempts beauticians; and so on.

The following states specifically exempt physicians from non-compete agreements:

- Alabama

- Arizona

- Colorado

- Delaware

- Illinois

- Maryland

- Tennessee

- Texas

In a few states, non-compete agreements are not enforced at all. In North Dakota and Oklahoma, for example, non-compete agreements are unenforceable. California has gone a step further: Not only are noncompete agreements unenforceable, but an employer who requires employees to sign them can be sued, even if the employer never tries to enforce the agreement.

If your state doesn’t allow employers to require employees to sign noncompetes, you should bring this to your employer’s attention immediately – and don’t sign the agreement. Be sure to verify your state’s regulations regarding non-compete agreements before implementing them in your practice.

What Happens If You Break a Non-Compete Agreement?

Generally, if you violate a valid and enforceable non-compete agreement, it is likely that your former employer will file a lawsuit against you. This lawsuit could seek compensation for money damages and actual losses suffered by your employer, it could simply seek to enforce the non-compete agreement by filing a court order against you, or could seek both money damages and a court order. In very rare cases, the court may prevent you from working for a competitor for the duration specified in the non-compete.

There could be serious legal consequences, so be sure you have appropriate counsel evaluate the agreement before signing it and advise you of professional moves after signing it.

What to Do If You Are Asked to Sign a Non-compete Contract

Bottom line, our recommendation is before you sign any papers, always have a lawyer well-versed in your particular state laws review your agreement, then negotiate something you feel is reasonable. This empowers you to be more informed of the legal ramifications of signing a non-compete agreement rather than just hoping things will work out – you’ll be saving yourself money and headaches down the line.

For example, if you’re asked to sign a broad agreement that could significantly restrict your ability to earn a living in the future, it would be well worth consulting with a lawyer to find out whether the agreement is legal and learn what steps you can take to negotiate a more limited arrangement with your employer. One of the most important factors of a non-compete agreement is the time frame it encompasses. Determine the effective dates of the agreement well in advance and seek legal counsel, as employers can set non-compete agreements only within a realistic timeline and cannot permanently prevent former employees from furthering their careers in that field.

Holistic Billing Services knows it takes a lot to run a streamlined and effective practice. Serving your patients and treating them with the best holistic approaches should always be your top priority, but sometimes massive piles of paperwork, billing errors, and insurance delays can weigh you down and poorly affect your practice.

Our experts here at HBS believe that your success is our success. From handling medical billing and coding to offering consulting services and much more, our team is dedicated to making it feel like we’re in-house. With a focus on holistic practices, insurance background, and proven consultants, our team can work with you regarding all holistic practice-related matters, and even help you navigate legal complexities like non-compete agreements. Contact us today!

The Centers for Medicare and Medicaid Services (CMS) released a series of changes in 2018 to the way E/M coding would be documented and billed for reimbursement. In partnership with the healthcare billing community, we reacted swiftly to the announcement, pointing out a series of potential problems that could arise when the changes went into effect for integrative medicine practitioners. In response, CMS formed a working group to consider another way of streamlining documentation burdens without focusing away from the delivery of medically necessary care. After about a year of negotiations and planning, we are happy to report that the changes were finally released to the public as part of the 2020 Physician Final Rule.

Understanding E&M Codes

An abbreviation for “evaluation and management,” E/M codes (alternatively known as E&M codes or sometimes referred to as “office visits”) are used by private practices to bill for a range of encounters that occur between patients and physicians, therapists, or practitioners. As a subset of CPT coding (specifically, CPT code range 99201-99499), E/M codes provide three pieces of information to insurance providers for reimbursement.

- Patient Type: Indicates whether the patient is new or established.

- The setting of Service: Indicates where the healthcare services were provided. For most holistic practices, this will be an office or outpatient setting.

- Level of Service Provided: E/M coding indicates the complexity of the health services delivered. A higher value code suggests a more complex service.

Under the original E/M coding structure, the level of service was determined by a complex calculation involving three elements: patient history, physical examination, and medical decision making. Each factor required the appropriate documentation to help indicate what appropriate level of service and then to bill accordingly. While holistic practitioners could use time as a determining factor when substantial counseling or care coordination was involved, that process required them to follow a very ambiguous set of guidelines.

How Are E/M Codes Changing in 2021?

Federal E/M coding guidelines will undergo a substantial change as of January 1, 2021. These changes will specifically affect coding for office and outpatient visits (CPT codes 99201-99215), making them extremely important for holistic practices to review.

New E/M Coding Rules for 2021

- New patient level 1 code (99201) is eliminated altogether, reducing the number of levels for new patient E/M visits to four. Established patients will retain the standard five coding levels.

- History and physical examination will no longer be determining factors when identifying the appropriate level of care; this doesn’t mean documentation requirements are going away altogether. Clinically relevant history and examinations must still be documented when necessary.

- Medical decision making or time can be used to determine the appropriate level of service.

- Adjustments are made to Medicare reimbursements for E/M codes. Since only a few holistic services are eligible for Medicare reimbursements, they may not impact every practice.

What Do E/M Changes Mean for Your Holistic Practice?

The overall goal of these changes was to emphasize medical decision-making and reduce the overall volume of paperwork associated with documentation. Still, the changes could have broader consequences for many practices. Most EHR systems overly rely on multiple bullet point entries to document patient history and log physical exam results. These tend to slow down patient visits and used because it was integral to the calculation used to determine the proper level of service code for E/M billing. Since the changes coming in 2021 will focus exclusively on time and medical decision-making factors to make this decision, the electronic medical records used by holistic practices should be simplified and updated to reflect the updates and speed up documentation.

Medical decision making for E/M coding is broken down into four different types, each reflected by a specific range of CPT codes:

- Straightforward (codes 99202 & 99212)

- Low (codes 99203 & 99213)

- Moderate (codes 99204 & 99214)

- High (codes 99205 & 99215) (not recommended for holistic and integrative medicine practices.)

When making a “medical decision,” physicians or therapists must consider three distinct elements pertaining to the patient:

- Number and complexity of problems being addressed.

- Amount and/or complexity of data to be reviewed and analyzed.

- Risk of complications and morbidity or mortality of patient management.

These three elements are rated according to four escalating levels that match the four types of medical decision making. The final E/M code is determined by examining each element’s level to assess the overall complexity of the decision. In order to qualify for a “Moderate” E/M code, for instance, at least two of the three elements must be at least “Moderate.” If one element is “Low,” one is “Moderate,” and another is “High,” the final E/M code would fall somewhere in the “Moderate” range (CPT codes 99204 & 99214).

This form of decision making obviously brings some degree of ambiguity, but CMS has done its best to give clear guidelines within each element to minimize confusion. A more practical approach is for practitioners to make E/M code selections based on the amount of time they spend with patients. These guidelines are much simpler than previous versions. For example, to bill for a “Moderate” encounter with an established patient (CPT code 99214), the interaction must last between 30 and 39 minutes.

Holistic practices will have to reassess their documentation and EHR systems to ensure they’re providing the information insurance companies are looking for when evaluating E/M billing codes. By far the biggest shift will be the transition from an emphasis on patient history and physical exams, which will hopefully reduce the overall level of documentation in these categories.

There is a lingering question about how reimbursement rates will be affected by the 2021 E/M code changes. While most holistic practices will be billing private insurers instead of Medicare, their reimbursement structure is often impacted by changes made to Medicare rates. The team at Holistic Billing will continue to monitor the situation as more information becomes available following the 2021 rollout.

Prepare Your Practice for Success with Holistic Billing!

As a medical billing specialist with a particular focus on acupuncture billing, massage therapy billing, and chiropractic billing, Holistic Billing Services has been helping independent practices adapt to new regulatory guidelines for many years. We’re always watching for the latest insurance billing announcements that could impact your holistic practice. We make sure we’re delivering the very best advice when it comes to your credentialing, billing and coding needs. If your acupuncture, massage therapy, or chiropractic practice needs help adapting to the latest round of E/M coding changes, the experts at Holistic Billing can provide the resources and guidance you need to boost your insurance reimbursements and keep your revenue cycle management moving along.

To find out what outsourced billing and coding services with Holistic Billing can do for your practice, contact our experienced team today!

Holistic providers who are considering accepting insurance generally have plenty of questions surrounding the issue of whether to bill under the practice name or use a personal social security number. If you’re establishing your practice, you might be tempted to just use your SSN – however, there are numerous advantages to utilizing an Employer Identification Number (EIN) attached to your practice.

Ultimately, the decision to bill under your SSN or EIN should be addressed prior to treating patients, ideally, after consulting with an accountant or attorney as to which makes the best sense for you. Keep reading to learn more about the benefits of an EIN compared to an SSN for medical billing!

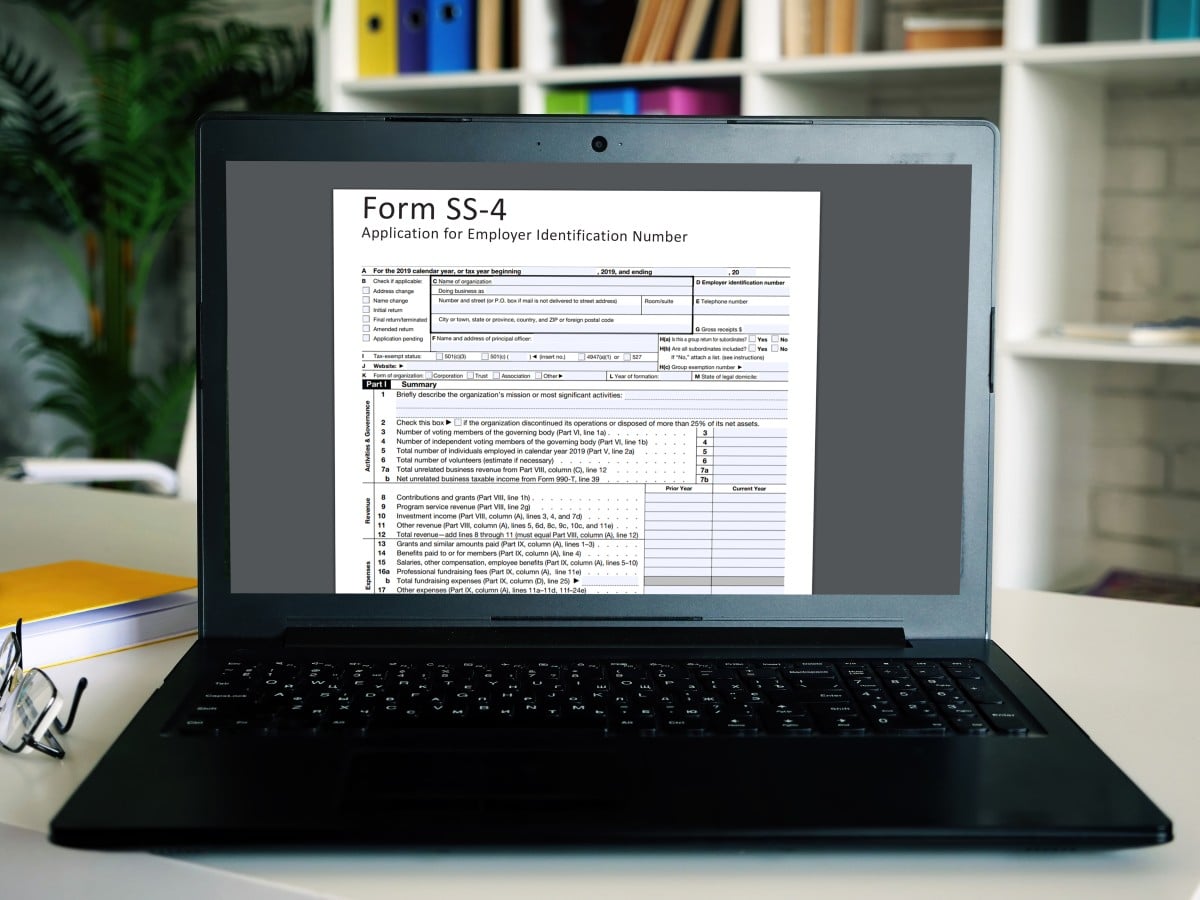

What is an EIN?

An Employer Identification Number (EIN) is something you may not have even heard of until recently, though it was an identification system established by the IRS in 1974. According to the IRS, “An employer identification number (EIN) is a nine-digit number assigned by the IRS. It’s used to identify the tax accounts of employers and certain others who have no employees.” If you don’t have employees, you aren’t required to get one – however, there are still valid reasons to do so, whether you plan to bring employees aboard or not.

Think of an EIN as a public social security number for your holistic practice. Similar to how each individual has a unique social security number, each business can have its own EIN. So if you’re the sole employee of your holistic practice, you can choose to use your social security number to identify your business. Nevertheless, there are some factors to consider before plastering your private, personal SSN on various business forms for your practice.

What are the Benefits of an EIN vs SSN?

When setting up the administrative side of your practice, it’s important to consider your options carefully. For example, comparing the benefits of utilizing an EIN instead of your personal SSN for medical billing might include the following points:

Using Your SSN for Medical Billing Puts You At Risk for Identity Theft

Applying for an EIN – which takes about 10 minutes – instead of using your private social security number will continue to keep this critical number safeguarded, reducing the risk of identity theft. Rather than broadcasting your personal SSN on various business forms, using your holistic practice’s EIN is more secure for your identity. It’s less likely for someone to break into your accounts when you keep business finances and personal finances separate. For example, If you’re a sole proprietor without an EIN, and you continue giving out your SSN to clients or vendors, you’re putting yourself at a higher risk.

An EIN Helps Establish Business Credit – and Benefits Your Finances

An EIN also means your practice is officially recognized as a legal entity. Therefore, you can start building credit for it! If you’re new to starting a holistic practice and unsure about how to build credit for your business, don’t worry. It’s essentially the same as establishing, managing, and utilizing your own consumer credit report information. In the same way you established your personal credit to apply for credit cards, mortgages, or even personal loans, your new practice needs to establish credit. In fact, most banks require an EIN in order to open a business banking account; this will simplify the process of tracking and managing your professional expenses, and, as a result, you’ll be able to make more efficient budgeting plans for your holistic practice. Plus – in the worst case scenario – if your practice files for bankruptcy, your personal assets are protected from business losses.

Another advantage to distinguishing your personal assets from your holistic practice’s deals with taxes; filing taxes on behalf of your holistic practice with an EIN separately from your personal accounts might result in tax benefits. Be sure to consult your tax professional to compare rates and see where your holistic practice’s EIN might come in handy with Uncle Sam.

Utilizing an EIN Aids the Hiring Process

If you’re starting your holistic practice and you’re its sole employee, it might be hard to imagine now — maybe your practice is just getting started, you like the pace, and you’re excited about going it alone — but you may want to hire additional employees sometime in the future. And when you do, you will absolutely need an EIN. It’s a requirement by the IRS for taxation purposes, plus you’ll need it for any payroll systems you set up. An EIN is a small thing now that can make a big difference and help reduce headaches in the future of your holistic practice!

How To Get an Employee Identification Number (EIN)

It might be uncommon to hear a government form described as simple or easy, but we promise applying for an EIN is just that! This process takes less than 10 minutes, it’s free, and it can really impact the administrative aspects of your holistic practice.

It might be uncommon to hear a government form described as simple or easy, but we promise applying for an EIN is just that! This process takes less than 10 minutes, it’s free, and it can really impact the administrative aspects of your holistic practice.

Here’s how to do it:

1. Grab your laptop and visit the IRS’s online EIN Assistant page.

2. Follow the EIN Assistant’s instructions and submit the information requested.

3. After your application is submitted, you’ll get your EIN immediately.

4. Be sure to write this number down somewhere safe so you always have it handy.

That was easy! We here at Holistic Billing Services know it takes a lot to run a streamlined and effective practice. Serving your patients and treating them with the best holistic approaches should always be your top priority, but sometimes massive piles of paperwork, billing errors, and insurance delays can weigh you down and poorly affect your practice.

Our experts here at HBS believe that your success is our success. From handling medical billing and coding to offering consulting services and much more, our team is dedicated to making it feel like we’re in-house. With a focus on holistic practices, insurance background, and proven consultants, our team can work with you regarding all holistic practice-related matters, and even help you navigate legal complexities like non-compete agreements. Contact us today!