There are nearly 11,000 CPT codes to account for all the different variations of healthcare treatments. While your chiropractic practice will only need a fraction of these codes, it’s vital that the chiropractic CPT codes are current and accurately reflect the services rendered.

If you’re utilizing chiropractic CPT codes that aren’t appropriate or are keyed incorrectly, your reimbursements can be delayed or your claims can be rejected. In any case, this will disrupt your overall revenue cycle.

Since the CPT codes are updated to some degree every year, let’s review the new changes and essential codes for your chiropractic practice!

New Chiropractic CPT Codes and Changes for 2023

All chiropractic services rendered in 2023 must align with the patient’s condition and can only be billed if they are reasonably and medically needed.

Along with this, you’ll only bill for direct services provided to patients – care and treatment provided by the patient, unskilled assistant, or office technician without the supervision of a licensed provider won’t be recognized as professional therapy.

A majority of the CPT codes that were updated or revised for 2023 deal with simplifying the language used for evaluation/management (E/M) codes for:

- Inpatient and observation care services

- Consultations

- Emergency department services

- Nursing facilities

- Home and residence services

- Prolonged services.

The American Medical Association (AMA) has more details regarding the changes for these categories of care, but some highlights include:

- Editorial revisions to the code descriptors to reflect the structure of total time on the date of the encounter or level of medical decision-making when selecting code level for inpatient and observation care services

- Deletion of lowest level office (99241) and inpatient (99251) consultation codes to align with four levels of Medical Decision Making (MDM)

- Revision to nursing facility guidelines with new “problem addressed” definition of “multiple morbidities requiring intensive management,” to be considered at the high level for initial nursing facility care

- The domiciliary or rest home CPT codes (99334-99340) were deleted and merged with the existing home visit CPT codes (99341-99350)

- A new code (993X0) was created to be analogous to the office visit prolonged services code (99417); this new code is to be used with the inpatient or observation or nursing facility services

Essential Chiropractic CPT Codes and Modifiers for 2023

While there are numerous chiropractic CPT codes, there are four main CPT codes chiropractors use for reimbursements; each code represents a specific region of the spine that was treated. These main codes are as follows:

- 98940: Used for the examination, diagnosis, and manipulative treatment of one to two spinal regions

- 98941: Used for the examination, diagnosis, and manipulative treatment involving three or four spinal regions

- 98942: Used for the examination, diagnosis, and manipulative treatment involving five or more spinal regions

- 98943: Used to report chiropractic manipulation of one or more of the extra-spinal regions

There are additional two chiropractor modifier codes commonly used. These can be attached to certain CPT codes to tell insurance providers that some of the treatments the CPT code describes were slightly altered.

If your selected CPT code requires a modifier but you fail to include it, your claim will likely be denied by the insurance company:

- Modifier 25: This Modifier is used to report a significant and separately identifiable Evaluation and Management (E/M) service on a day when another service was provided to the patient by the same physician or other qualified healthcare professional

- Modifier 59: Use this Modifier to report a procedure or service that was distinct or independent from other non-E/M services performed on the same day

When billing for these chiropractic CPT codes, remember these points:

- Report the initial treatment procedure

- Report the date of the X-ray if it was applied, including the X-ray film

- If an X-ray is unavailable, a physician’s examination may be used to document subluxation. The physical examination record must reflect the subluxation.

- Report subluxation using the recommended ICD-10-CM code

- All treatment procedures should be categorized as maintenance therapy, chronic subluxation, or acute subluxation

Direct Patient-Chiropractor Care CPT Codes

When billing for chiropractic care, you can only quantify the time that is spent with direct patient-chiropractor care; the client waiting for equipment or resting in your office doesn’t qualify as direct care, so it can’t be billed.

Refer to these ranges of chiropractic CPT codes to find the one that is most appropriate for chiropractic services rendered:

- 97032-97039

- 97530-97546

- 97110-97150

Transform Your Medical Billing with HBS!

Staying on top of your chiropractic practice’s appointments, SOAP notes, billing, and coding, all the while delivering care to your patients can be overwhelming. Save time, energy, and streamline your revenue cycle management by bundling your practice management with outsourced insurance and Medicare billing for your chiropractic practice!

As an experienced EMR and insurance billing provider for holistic practices, Holistic Billing Services can help your practice navigate the billing process to minimize denials and increase revenue. With a knowledgeable partner by your side, you can focus more on treating patients to help your chiropractic practice grow rather than worrying about insurance billing.

To learn more about our chiropractic billing services, talk to one of our friendly billing and coding experts today!

Did you know that roughly 30% of medical billing claims are rejected? That’s a significant chunk of your overall healthcare revenue cycle that will cost you in the short and long run. These claims might be rejected for a few reasons – a key one which is inaccurate coding.

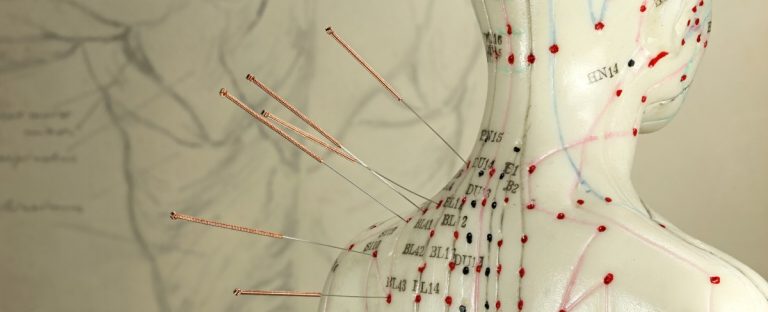

That’s why it’s essential for your acupuncture practice to leverage current CPT codes that accurately reflect the services rendered. Having to rework claims results in costly reimbursement delays plus it takes up your time and energy!

If your holistic practice continues to make mistakes with acupuncture CPT codes, you can have increased denial rates and declining insurance reimbursements, which could put your practice at risk. Accurate acupuncture CPT codes and billing practices can help ensure your holistic practice reaches its full revenue potential.

We want to help reduce your medical billing stress, so we’ve compiled a handy reference list of the acupuncture CPT codes to use in 2023. Be sure to bookmark this page so you can easily access it!

Top 4 Essential Acupuncture Billing Codes for 2023

The bulk of the services you will bill to insurance will likely fall under four essential acupuncture CPT codes. Since acupuncture services are always billed in 15-minute increments, your practice will use one code for the initial 15 minutes of service and then a separate code for additional units of time.

Your acupuncture CPT codes will only vary if you include electronic stimulation in your treatment.

- 97810 Initial Acupuncture: Initial 15-minute insertion of needles, personal one-on-one contact with the patient. (Do not report in conjunction with 97813; use one or the other.)

- 97811 Subsequent Unit of Acupuncture: Use one unit per each additional 15 minutes of personal one-on-one contact with the patient after the initial 15 minutes, with re-insertion of needles. (May be used in conjunction with either 97810 or 97813)

- 97813 Initial Acupuncture with Electrical Stimulation: Initial 15-minute insertion of needles, personal one-on-one contact with the patient. (Do not report in conjunction with 97810; use one or the other.)

- 97814 Subsequent Unit of Acupuncture with Electrical Stimulation: Use one unit per each additional 15 minutes of personal one-on-one contact with the patient, with re-insertion of needles. (May be used in conjunction with either 97810 or 97813)

Acupuncture CPT Codes for Medicare

January marks the three-year anniversary of Medicare expanding their coverage options to include acupuncture for treating chronic lower back pain. CPT codes related to billing Medicare for acupuncture treatments are as follows:

- 97810: Acupuncture, one or more needles, without electrical stimulation, initial 15 minutes of personal one-on-one contact with the patient

- 97811: Each additional 15 minutes of personal one-on-one contact with the patient, with re-insertion of needles

- 97813: Acupuncture, one or more needles, with electrical stimulation, initial 15 minutes of personal one-on-one contact with the patient

- 97814: Each additional 15 minutes of personal one-on-one contact with the patient, with re-insertion of needles

- 20560: Services with needle insertion(s) without injection(s) of 1 or 2 muscle(s)

- 20561: Services with needle insertion(s) without injection(s) of 3 or more muscle(s)

Prices will depend on the region of your holistic practice; look up specific codes based on your location here.

Acupuncture CPT Codes for Patients

Medical billing codes for patients can be broken down into two categories, new and returning patients:

2023 Billing Codes for New Patients

Use these acupuncture CPT codes for when your holistic practice receives new patients. As a reminder, a new patient is defined as a patient who hasn’t received professional services from you or another provider of the same specialty who has belonged to your practice within the past three years.

- 99202 Evaluation/Management (Expanded): Presenting problems are of low to moderate severity; requires an expanded problem-focused history, an expanded problem-focused examination, and straightforward medical decision-making; the provider typically spends 20 minutes face-to-face with the patient

- 99203 Evaluation/Management (Detailed): Presenting problems are of moderate severity; requires a detailed history, a detailed examination, and medical decision-making of low complexity; the provider typically spends 30 minutes face-to-face with the patient

- 99204 Evaluation/Management (Comprehensive): Presenting problems are of moderate to high severity; requires a comprehensive history, a comprehensive examination, and medical decision-making of moderate complexity; the provider typically spends 45 minutes face-to-face with the patient

Billing Codes for Returning Patients

These CPT codes for acupuncture can be used for your established patients. Returning patients are those who have received any professional services from you or another provider of the same specialty who has belonged to your practice within the past three years.

- 99212 Evaluation/Management (Limited): Presenting problems are self-limited or minor; requires a problem-focused history, a problem-focused examination, and straightforward decision-making; the provider typically spends 10 minutes face-to-face with the patient

- 99213 Evaluation/Management (Expanded): Presenting problems are of low to moderate severity; requires an expanded problem-focused history, expanded problem-focused examination, and medical decision-making of low complexity; the provider typically spends 15 minutes face-to-face with the patient

- 99214 Evaluation/Management (Detailed): Presenting problem(s) are of moderate to high severity; requires a detailed history, a detailed examination, and medical decision-making of moderate complexity; providers typically spend 25 minutes face-to-face with the patient

Medical Billing Codes for Physical Therapy Treatments

Acupuncture practices use a variety of treatments and modalities to help their patients; your practice may bill for the following:

- 20550 & 20551 Tendon Injection: Single tendon injection for the treatment of fasciitis. Could include multiple injections into a single tendon sheath (CPT code 20550) or the tendon origin (CPT code 20551)

- 20552 & 20553 Muscle Injection(s): Injections involving single or multiple trigger points. Could be used to treat one or two muscles (CPT code 20552) or three or more muscles (CPT code 20553)

- 97010 Heat Therapy: Application of a modality to one or more areas; hot or cold packs

- 97016 Cupping: The use of a vasopneumatic device may be considered reasonable and necessary for the application of pressure to an extremity for the purpose of reducing edema

- 97026 Infrared Therapy: The application of infrared therapy is considered medically necessary for patients requiring the application of superficial heat in conjunction with other procedures or modalities to reduce or decrease pain/produce analgesia or reduce stiffness/tension, myalgia, spasm, or swelling

- 97110 Therapeutic Exercise: One or more areas, every 15 minutes; therapeutic procedures to develop strength and endurance, range of motion, and flexibility with direct (one-on-one) patient contact

- 97112 Neuromuscular Reeducation: Treatments to restore movement, balance, coordination, kinesthetic sense, posture, and/or proprioception for sitting and/or standing activities with direct (one-on-one) patient contact

- 97140 Manual Therapy: Techniques such as mobilization and manipulation, manual lymphatic drainage, and manual traction, one or more regions, every 15 minutes with direct (one-on-one) patient contact

- 97124 Massage Therapy: Includes effleurage, petrissage, and/or tapotement (stroking, compression, percussion) with direct (one-on-one) patient contact

- 97530 Kinetic Activities: Use of dynamic activities to improve functional performance, every 15 minutes with direct (one-on-one) patient contact

Medicare Billing Codes for Principal Care Management (PCM) in 2023

Principal care management involves managing a single, complex chronic condition; the goal here is to deliver a focused treatment and management plan that addresses a patient’s chronic condition.

- 99424: Principal Care Management performed by a physician or non-physician provider for 30 minutes per calendar month

- 99425: Additional 30 minutes per calendar month

- 99426: PCM performed by clinical staff under the direction of a physician or other qualified healthcare professional for 30 minutes per calendar month

- 99427: Additional 30 minutes per calendar month

These codes will allow providers to report care management services for patients with chronic conditions, such as lower back pain, in an effort to improve monitoring these complex health problems.

Transform Your Medical Billing with HBS!

Balancing your acupuncture practice’s appointments, SOAP notes, billing and coding, all the while delivering care to your patients can be overwhelming. Save time, energy, and streamline your revenue cycle management by bundling your practice management with outsourced acupuncture insurance and Medicare billing!

As an experienced EMR and insurance billing provider for holistic practices, Holistic Billing Services can help your practice navigate the billing process to minimize denials and increase revenue. With a knowledgeable partner by your side, you can focus more on treating patients to help your acupuncture practice grow rather than worrying about insurance billing.

To learn more about our acupuncture billing services, talk to one of our friendly billing and coding experts today!

Your holistic practice’s longevity and financial success depends on how efficiently and effectively you can manage your revenue cycle.

Without ensuring this key component of your strategy is running smoothly, you’ll be struggling to keep your practice in the green.

A comprehensive revenue cycle management strategy can really transform your holistic practice and help chart the course of your practice’s future. But what exactly is a revenue cycle and how do terms like accounting or medical billing factor in?

We’ll break it down in this article; keep reading to learn more!

What Is Revenue Cycle Management?

In the most general definition, revenue cycle management, sometimes shortened to RCM, encompasses the identification, collection, and management of a practice’s finances based on the services rendered.

In other words, RCM refers to the processes required to manage and streamline the various components of a holistic practice’s financial standing.

The typical steps of a practice’s revenue cycle are as follows:

- Patient registration and scheduling

- Prior authorizations and eligibility verification

- Patient visit and treatment

- Documentation

- Charge capture and charge entry

- Medical coding

- Medical claim submission

- Payment posting or denial

- If claims are rejected, rework and resubmit until you get the money owed

A frequently asked question regarding RCM: who exactly is involved in the revenue cycle at your holistic practice? The short answer is everyone!

This includes your

- Patients

- Payers, whether it’s insurance companies or government programs

- Staff

Anything to do with the financial side of your holistic practice is, obviously, vital for its long-term presence in your community and your ability to scale up in the future.

For instance, effectively managing rejected claims and establishing processes that address errors in your claims is a foundational step to optimizing your overall revenue cycle management strategy.

What’s the Difference Between Medical Billing and Healthcare Accounting?

Since there are so many facets of the healthcare revenue cycle, it’s easy to use other financial terms interchangeably. Take medical billing and accounting—what do these two concepts actually mean and how do they relate to your holistic practice’s RCM?

Let’s break them down here:

Medical Billing

Medical billing is the process of translating a patient’s delivery of care into a financial representation so that your practice can be reimbursed for services rendered.

This process involves medical billing codes and submitting claims to insurance companies, Medicare, the VA, or whatever other payer programs relevant to your patients, so that you can receive money from them for the services you provided.

Healthcare Accounting

On the flipside, healthcare accounting is the practice of processing and recording financial transactions; basically, what you do in your personal finances but perhaps with a few more figures thrown into the mix.

Healthcare accounting includes a few different standards for performance, such as accounts receivable and accounts payable, which are two metrics that are vital to benchmarking your holistic practice’s financial health.

Effective Revenue Cycle Management Depends on Accurate Medical Billing

As the old adage goes, time is money. Nowhere is that truer than in the case of your holistic practice’s revenue cycle! Ensuring your medical billing process is streamlined and as accurate as possible might take some time and effort to establish but will bring tremendous benefits to your practice.

A streamlined medical billing and coding process means you’re only working each of your claims once and submitting them promptly so that you can get paid in a timely manner! Reworking claims happens to the best of us, but should be the exception, not the rule.

The sooner you can minimize bottlenecks and clunky medical billing processes, the better off your practice will be!

Partner with Holistic Billing Services to Optimize Your Revenue Cycle!

Partnering with a medical billing firm to handle your medical billing can radically transform your holistic practice’s revenue cycle.

A trusted firm can empower your practice with comprehensive reporting and can act as an in-house expert for all your revenue cycle needs. With the medical billing burden off your shoulders, you can focus on what matters most: delivering quality care to your patients.

With the friendly experts at Holistic Billing Services, you’ll have decades of experience by your side who can help navigate the worlds of medical billing, healthcare software, and more! Ready to optimize your revenue cycle?

Did you know that the US chiropractic industry is worth around $15 billion? Chiropractors treat approximately 35 million Americans annually and that figure is only growing as people continue to turn towards holistic treatments to help their ailments.

If you’re wondering how your chiropractic practice can attract new patients while retaining current ones, then your marketing strategy is one of the core features of your operations to evaluate and refine.

From leveraging word of mouth referrals to encouraging your patients to leave reviews, we’ll dive into a few top marketing tips for chiropractors that can help promote your practice in a sustainable manner.

Keep reading to learn more!

How Much Should You Budget for Advertising Your Chiropractic Practice?

One of the immediate questions you likely have for any facet of your practice is about cost: how much something will cost, how can you be sure it’s worth it, how much effort will it take you to execute, etc. are all valid queries. Marketing efforts are no exception, of course.

It’s recommended that you spend around 5% of your gross revenue on marketing efforts if you want to maintain your practice and somewhere between 7% and 15% of your gross revenue if you’re wanting to expand and scale your practice.

For example, if your gross revenue is $10,000 per month then you should put aside $500 for marketing initiatives. Of course, marketing budgets can change over time and other factors come into play, so these numbers are all relative to your particular practice and goals.

What Is a Customer’s Lifetime Value + How Does It Impact Your Marketing Efforts?

Your patients are how you keep the doors open–or rather, the profits you garner from delivering great chiropractic care to them are how you keep the doors open. But how can you estimate the financial gains your practice will earn from each patient?

That’s where knowing a customer’s lifetime value is the ace up your sleeve. Abbreviated as CLV, this formula helps you anticipate the total financial worth of a patient at your chiropractic office. This math can be applied to any industry and is especially helpful to those working in the healthcare and service fields.

A customer’s lifetime value can be calculated in the following way:

Average Annual Value x Relationship Years + Patient Referral Value

= Customer Lifetime Value

Let’s put this into practice and say you have a patient who visits your chiropractic practice once a month and each visit costs $100. The total revenue generated is $1,200 and you factor in a 20% profit margin, so the Average Annual Value of that patient is $240.

Let’s say this patient continues to visit your practice for 5 years before moving to another state; the math would shake out to this:

AAV ($240) x Relationship (5 years) = $1,200

When you start consistently tracking this metric at your chiropractic practice, you can leverage marketing tactics and strategies around pricing, sales, patient referrals, patient retention, and more in order to reduce costs and boost your profits.

After all, knowledge is power–when you know what to financially anticipate from a typical patient over the course of their relationship with your practice, you can make better informed decisions about how you engage them.

For example, if you know that an average CLV at your chiropractic practice is about $500, then you wouldn’t want to exceed that figure for your marketing budget.

Take a Crack at These Marketing Tips for Chiropractic Practices

Ready to revamp or ramp up your marketing efforts to maintain or scale your chiropractic office? Check out these marketing tips:

Keep Your Website Updated and Accessible for Mobile Users

Everything and everyone are online these days, so it’s imperative that your practice has a solid website that looks professional. Potential patients will find your website while searching for chiropractors to check out, so having a nice website that reflects you and your practice can help distinguish you from the competition.

In addition to ensuring that your site is optimized for mobile users, which is a feature in most DIY website building platforms, consider including the following:

- A section that outlines your background and the values that guide your practice

- Your mission statement

- Contact information, hours of operation, location details, and more

- A place for announcements or specials

- Social media links

- A blog where you demonstrate your expertise and interests through engaging articles

- Link to leave a review on Google and other rating sites

- And more!

Personalizing your site will help clients, both new and existing, learn more about you; building that relationship is critical to long-term success!

Get Engaged with Your Community

Engaging with your community can take form in a multitude of ways, ranging from hosting an open house to sponsoring a little league team or offering discounts for first responders and veterans. Whatever you’re passionate about, see if there’s an existing event or organization you can connect with–or start your own initiative to spread the word! This demonstrates your care for those in your community and helps raise awareness of your practice and values.

Don’t Ignore Social Media Platforms

Just about anything can go viral these days–why not a montage of your crunchiest chiropractic cracks? Or maybe you have a charming parakeet in your waiting room that the internet would love to meet. Regardless of the potential to go viral, utilizing social media platforms is a no-brainer to connect with your patients and keep them informed of what you have going on each month.

Wish You Had More Time to Get Creative with Marketing Strategies? Partner with Holistic Billing Services!

Marketing efforts can take creativity to ideate, time to execute, and energy to maintain and track–if you’re swamped with your medical billing and coding processes, then you already don’t have the bandwidth to pursue this important component of your practice!

Your friendly experts here at Holistic Billing Services completely understand where you’re coming from, and we have the experience you need to support your revenue cycle. From accurate coding and prompt submission of claims to answering your questions and keeping up with healthcare legislation, we’re here to help you succeed!

As you know, there are countless healthcare KPIs (key performance indicators) to review, to monitor over time, and to create goals for improving. We know that the process of pulling reports on so many different KPIs can be overwhelming and confusing, which ultimately makes the process ineffective.

That’s why we love to write various articles that emphasize and explain different metrics to track, their role in your overall operations, and best practices for analyzing them. Today we’re highlighting a financial metric that is often overlooked but which has a tremendous impact on your healthcare revenue cycle: payer reimbursements.

Keep reading to learn more about payer reimbursements, how they play a role in your holistic practice’s revenue cycle, and our top tips for evaluating them.

What Are Payer Reimbursements?

After delivering quality care to patients, the medical coding and billing process begins so that the patient, insurance company, or government program can pay for the services rendered: these are known as payer reimbursements.

Depending on how your holistic practice operates, you might bypass insurance companies or government payer programs like Medicare and opt for the patient to be solely responsible for paying for your services. On the other hand, you might accept insurance or Medicare so that you have a wider pool of patients to attract, in addition to the patient-payer model.

Either way, someone or some entity is paying for the work that you deliver to your patients, and this is why payer reimbursements is a key financial metric to be aware of and track for your holistic practice.

How Do Payer Reimbursements Affect Your Healthcare Revenue Cycle?

Here’s a well-kept secret: your holistic practice needs money to operate, sustain itself, and grow over time. Payer reimbursements affect your healthcare revenue cycle because without consistent, accurate, and timely payments, your practice can’t function.

Therefore, tracking this KPI helps you determine a baseline for your practice’s financial standing and empowers you to know where any discrepancies might be falling through the cracks. Tracking this metric means you’ll have a clear understanding of where, when, and how your holistic practice is getting paid or if there are any areas that need attention.

Top Tips for Analyzing Your Holistic Practice’s Payer Reimbursements

Check out our top tips for analyzing your holistic practice’s payer reimbursements:

Learn Your Payer Reimbursements Through and Through

As the saying goes, knowledge is power. That’s why our first tip for analyzing your practice’s payer reimbursements is to leave no stone unturned and to delve into each case. After all, you don’t know what you don’t know—so do your due diligence to investigate the current standings of your payer reimbursements!

Catching problematic patterns or infrequent inconsistencies in your payments enables you to address them before they continue to cause an unstable financial performance for your practice. Whether it’s a problem caused by inaccurate coding or a payer’s unintentional miscoordination or some other factor, your analysis gives you the power to resolve it.

Plus, with a close eye on your insurance contracts, Medicare billing processes, and patient-payers, you can spot each inaccurate payment as soon as it happens so that it doesn’t spiral into a bigger problem.

Build habits based on best practices, such as:

- Scrub insurance and Medicare claims prior to submission to ensure they’re coded properly

- Keep the lines of communication open with your payer contacts to make sure accurate rates are paid

- In the instance of any underpayment—be it your fault, or the payer’s—follow up and get every dollar you’re owed

Unless you’re applying resources to address reimbursement accuracy, you put your profitability at risk.

Evaluate Your Payer Reimbursements with These Questions

When reviewing this financial metric, ask yourself a few questions to gain a deeper understanding of what’s going on:

- Compared to your payer contracts, whether that’s with your individual patients or with an insurance company or Medicare, are the reimbursements accurate?

- Which payers are deviating from set rates?

- Are the under or overpayments happening consistently, or sporadically?

Review your data for the last six months; this is a substantial time period to examine without overwhelming yourself with trends of previous years. Ideally you won’t find any of these issues, but if you do, then you’re able to pinpoint which issues are stemming from where.

Be Conscious of Issues at the Start of the Year

Payer reimbursement issues can happen at any time but can be especially more likely when the new year rolls around in January. Inaccurate reimbursements can be the result of a misaligned fee schedule when payers have yet to update their systems with new codes and updated relative value units (RVUs).

Optimize Your Revenue Cycle with Holistic Billing Services!

Your holistic practice can’t effectively function on an ineffective revenue cycle, which is why examining your payer reimbursements metric is essential for financial success.

However, if you find yourself overwhelmed with the medical billing process, frequent issues with accurate coding, and general confusion regarding billing insurance companies or Medicare, then you’ll have an even bigger struggle for financial clarity.

Partner with the friendly experts at Holistic Billing Services to handle the complicated responsibility of your medical coding and billing processes! We’ve got billing specialists for your specialty and your success is our success.

Take a minute to reflect on your holistic practice’s current marketing strategy; where are your efforts being directed? How frequently do you check in on the performance of your marketing efforts? How can you tell if they’re effective or if they need refining?

Marketing is an essential element of nearly every business or organization, of course, but the number of metrics at your fingertips can be overwhelming. Or, if you haven’t invested a lot of energy into your marketing strategy, then you might be unsure where to start or how to approach it.

In this article, we’ll tackle how marketing impacts your holistic practice and which metrics to track for success.

How Does Marketing Impact Your Holistic Practice?

Marketing entails a whole host of efforts and initiatives that impact your practice in a few manners:

Attract New Patients

Your patients won’t know you exist without some type of marketing strategy. Whether that’s word of mouth from current clients, search results advertisements, setting up a table at a local event, or something else, your holistic practice needs to market itself in order to make your community aware of your services.

Plus, if your marketing efforts are the first time a future client has ever heard of you, you’re able to make a great impression and lead with your best foot forward!

Keep Patients Informed of New Initiatives

Marketing is also great for your current clients to retain them and inform them of any new initiatives that you’re developing. For example, you might be moving to a bigger location and bringing on another practitioner. You can make a great marketing campaign around this, which is both engaging and informative!

This is important to take into consideration when building out your marketing strategy ideas because retaining a client is cheaper than attracting a new one; be sure your branding speaks to your current clients and keeps them in the loop with your practice.

Build Your Reputation

Beyond attracting and retaining your clients, marketing is how you build and refine your holistic practice’s reputation. Do you have decades of experience within your community? Do you make a point of volunteering in your community? Cater specifically to veterans in your area? Whatever makes your practice special is what you should convey in your marketing efforts.

This helps build rapport with clients, both current and potential, and establishes your practice in your community.

Marketing Metrics: What to Track

Now that we’ve addressed how marketing can be a powerful tool to leverage and have a significant impact on your holistic practice, let’s look into three key marketing metrics to track along the way:

Cost Per Lead (CPL)

This metric calculates the total amount spent on a marketing campaign and divides it by the number of leads your holistic practice got as a result:

Cost of Campaign / Number of Leads = Cost Per Lead

For example, if you spent $1000 on a campaign and you got 50 leads from it, then the cost per lead would be $20. On the other hand, if you spent $1000 but only received 10 leads, then the CPL is $100.

It’s important to note that the only way you can effectively calculate this metric is if you know the specific origin of a new lead. That’s why it’s helpful to ask your new leads how they heard about you; did they see an advertisement on social media? Hear about you from a friend? Tracking these origins is great to know where new leads are coming from.

Patient Acquisition Cost (PAC)

Patient acquisition cost provides you with the number of paying patients your holistic practice earns from a particular marketing campaign:

Cost of Campaign / Number of Paying Patients = Patient Acquisition Cost

This marketing metric helps you understand the more real, tangible cost of bringing in new revenue to your holistic practice. Following the same example, if 10 leads of the pool of 50 turns into actual paying clients, then the PAC is $100.

Return on Investment (ROI)

Figuring the ROI on a marketing campaign involves just a little more math and looks something like this:

Income Derived / Cost of Campaign X 100 = ROI

This first factor, the total income earned, involves you calculating the lifetime value of a patient. Let’s say each of the 10 new patients you acquired spends around $800 over the course of their relationship with your practice. That total amount would be $8,000.

$8,000 / $1,000 X 100 = 800%

This metric is helpful for monitoring the overall revenue generated from a particular marketing effort. This perspective is helpful for determining if a marketing campaign was “successful” depending on your holistic practice’s expectations or if something should be tweaked in the future.

Let Holistic Billing Services Streamline Your Healthcare Revenue Cycle!

Wish you had more time to spend refining your marketing efforts and engaging with the patients in your holistic practice? Find yourself overwhelmed and frustrated trying to figure out new billing regulations? Tired of dealing with rejected medical claims or medical coding inaccuracies that bring your healthcare revenue cycle to a stop? Partner with Holistic Billing Services to handle all your medical coding and billing needs!

Our team of experts has decades of experience and expertise in your specialty, so you know you’re in good hands. We know you just want to get back to what matters most: your patients. We’re eager to help, so contact us today!

The healthcare revenue cycle is fraught with various moving parts and pieces that can throw a wrench in your financial performance; one such example is that of rejected claims, which can delay your payment for services rendered, cause extra stress, and result in lower financial performance for your holistic practice.

The ideal metric for tracking the performance of your claims processing strategy is to have a 95% or higher clean claims rate—in other words, you want to aim for at least 95% of your claims to be processed without issue. These clean claims demonstrate that your medical coding and medical billing approach is effective and efficient. Reworking rejected claims costs your practice time and money, plus it causes unnecessary headaches.

While a 95% clean claims rate is ideal, the reality is that practices average 75-85% clean claims, which means that up to a quarter of revenue is being held up by rejected claims. If your holistic practice accepts insurance or patients covered by Medicare, then this can significantly stymie your healthcare revenue cycle.

Hence minimizing rejected claims is a priority; in this article, we’ll dive into how rejected claims help your practice, hinder your practice, and some best practices for the medical billing and coding process.

How Rejected Claims Help Your Practice

It might sound counterintuitive, but if you shift your perspective to see rejected claims as something that can help your holistic practice, then you’re already on the right track.

Rejected claims can present an important opportunity for your holistic practice’s overall revenue cycle in terms of revealing the points of improvement in your medical coding and billing process.

Rejected claims were, more often than not, rejected for important reasons—maybe the claim wasn’t completely filled out, perhaps the codes were inaccurate or didn’t fully illustrate the services rendered, or something else happened.

Gather your rejected claims over the last 6 months or so and evaluate the frequency of claims being rejected, the reasons for the rejection, and the average time it took to correct and resubmit the claims. Armed with this information, you’ll notice where the points of improvement exist within your medical billing process.

Maybe you need to update the list of frequently-used medical billing codes that you reference when filling out your claims or perhaps one important part of the claim is constantly left blank by accident. Whatever the case, taking the time to see why the rejected claims are happening can empower you and your holistic practice to refine your internal medical billing and medical coding process.

Since insurance or CMS claims can be a significant portion of your holistic practice’s overall healthcare revenue cycle, rejected claims can reveal where your financial performance needs more attention or education.

How Rejected Claims Hurt Your Practice

Of course, on the other hand, if you can avoid dealing with rejected claims then you should absolutely do so! These types of claims cost your holistic practice time and money and negatively impact your revenue cycle.

By having to spend more time reworking a claim, you’re unable to focus on more strategic initiatives like your marketing presence or attend to patient feedback. Plus, this time spent costs money; whether it’s the time you spend on the clock or paying for a team member to tackle the rejected claims issues, reworking claims can be costly.

If the average cost for filing a claim is $6.50, the average cost of a reworked claim is $25. This might not be too bad to deal with when only one or two claims need to be reworked, but if your holistic practice is dealing with dozens of rejected claims, then this amount can quickly add up!

For example, if you have 100 rejected claims in one month, you’ll have to spend an additional $2,500 per month. Now, think about it from an annual standpoint—that’s a whopping $30,000 each year. Plus, rejected claims result in delayed reimbursement, which slows down your practice’s revenue cycle and skews your financial performance metrics.

4 Steps to Minimize Rejected Claims

So what are some steps you can take to minimize the amount of rejected claims your holistic practice has to deal with? Check out these tips:

Verify Patient Eligibility Prior to the Date of Service

Established patients are great for your practice, but make sure you don’t assume their insurance coverage hasn’t changed over time. Simply asking them at every visit if their coverage has changed or if they have any patient information updates can save you and your practice time later down the line. Outdated patient information is a tremendous source of rejected claims, so take the extra minute ahead of time to confirm your patient’s information before proceeding with the claim.

Double-Check Medical Coding Modifiers

The world of medical coding and medical billing is complex and intimidating; one crucial step in the medical coding process is to verify that you’re utilizing the correct medical coding modifiers. These modifiers might seem too small to matter, but your claim can be rejected if not appropriately coded!

File Your Claims In a Timely Manner

Insurance companies and CMS typically require you to submit claims within a tight window of time, and missing that window can increase your chances of a rejected claim. Be sure to pay attention to claim filing deadlines and keep in contact with the pertinent insurance company if you encounter issues or have questions. Resolving any issues before filing a claim—while staying within the timeline—can help ensure your claim goes through without any troubles.

Outsource Your Medical Billing Altogether

If you find yourself and your team members swamped with rejected claims and simply wish you could make that part of your holistic practice disappear, then it’s time to consider partnering with a medical billing firm!

Outsourcing your medical coding and medical billing process to a trusted partner can immediately boost your revenue cycle and keep your holistic practice’s finances running smoothly. Plus, with the medical billing partner, you won’t have to worry about keeping up with esoteric legislation that impacts the billing process or stress about reworking claims since they’ll be handled correctly from the beginning.

Consider partnering with Holistic Billing Services to comprehensively manage your medical billing process so that you can focus on what matters most: your patients. Our experts have experience in your specialty, and we’re eager to help your holistic practice thrive!

Healthcare legislation can be tricky to navigate, especially when you’ve got a million other things on your plate. However, it’s still essential to keep up with because it can impact your holistic practice, healthcare revenue cycle, and patients.

One recent example is the No Surprises Act, which affects you, your patients, and your revenue cycle. This piece of healthcare legislation essentially aims to refine the medical billing process at the federal level—and we’ll dive into the details in this article here.

Keep reading to learn more about the No Surprises Act and its effects on your holistic practice!

What Is the No Surprises Act?

To sum up the No Surprises Act in one sentence? It’s intended to comprehensively mitigate surprise medical bills, which often occur when insured patients inadvertently receive care from out-of-network providers.

At the end of 2020, this piece of healthcare legislation was signed into law to provide federal-level protections for consumers against surprise medical bills. According to the handy Key Takeaways listed for the No Surprises Act, this legislation:

- Protects patients from receiving surprise medical bills resulting from gaps in coverage for emergency services and certain services provided by out-of-network clinicians at in-network facilities, including by air ambulances.

- Holds patients liable only for their in-network cost-sharing amount, while giving providers and insurers an opportunity to negotiate reimbursement.

- Allows providers and insurers to access an independent dispute resolution process in the event disputes arise around reimbursement; the legislation does not set a benchmark reimbursement amount.

- Requires both providers and health plans to assist patients in accessing health care cost information.

This Act was part of the Consolidated Appropriations Act of 2021, which handled a variety of public health and private insurance issues, and a majority of the initiatives outlined in this legislation took effect on January 1, 2022. The Departments of Health and Human Services (HHS), Treasury, and Labor are responsible for issuing regulations and guidance to implement many of the regulations.

How Does The No Surprises Act Impact Your Holistic Practice?

While sections of this new legislation won’t apply to your holistic practice—such as sections 105 and 106 that deal with air ambulance services and charges—there are still some important parts that might impact your practice, especially if you’re contracted with private health insurance companies.

The primary effect that this healthcare legislation has on the medical billing process is that out-of-network providers can’t bill patients for excessive charges, nor can the patient be held responsible for such charges.

How Does This Healthcare Legislation Impact Your Patients?

Ultimately, the No Surprises Act leads to enhanced transparency and patient engagement in the financial workings of your holistic practice. By increasing patient understanding of the medical billing process and what they are responsible for in the healthcare revenue cycle, patients can make informed decisions regarding their care.

Patient education and patient engagement are vital for your holistic practice, regardless of accepting insurance. Initiating the conversation with your patients about their responsibility for paying for services rendered is helpful because it encourages their questions and concerns. Utilizing these lines of communication can build rapport and trust between your patients and your holistic practice.

3 Medical Billing Tips for Your Holistic Practice

Whether your holistic practice is significantly or minimally, your healthcare revenue cycle and medical billing process can always benefit from a few tips:

Keep Patient Information Updated

From contact information to insurance carriers and more, there’s a lot of patient information that can change over time. Inaccurate patient information can lead to denied claims, which can throw a wrench in your holistic practice’s revenue cycle. Be sure to verify your patient’s data hasn’t changed or update their profile with new information on a regular basis to ensure nothing slips through the cracks.

Use Appropriate Codes and Modifiers

Medical coding accuracy plays a critical role in your practice’s revenue cycle; inaccurate or incomplete claims that use the wrong codes or modifiers can result in rejected claims that need to be reworked. Any additional time spent reworking claims means it’s costing your practice time and money instead of bringing in your reimbursement! Keep a list of frequently-used codes and modifiers so that you won’t have to look too hard for them when you’re filing claims.

Streamline Your Medical Billing Process by Partnering with a Medical Billing Firm!

Medical billing firms make it their job to stay updated on new healthcare legislation initiatives and ensure your revenue cycle is as optimized as possible. If your holistic practice is swamped with piles of claims that need to be filed or reworked, then it’s time to consider partnering with a medical billing firm to handle it.

With a medical billing partner, you’ll enjoy an immediate boost to your revenue cycle, more time to focus on patients, develop strategic moves for your practice, and gain insight into your financial performance.

Partner with Holistic Billing Services Today!

The experts at Holistic Billing Services are as invested in your success as you are—we work as an extension of your holistic practice! We’ve got experience in your specialty and can help you navigate the complexities of the medical coding and billing process so that you can focus on what matters most: delivering great care to your patients.

We offer a variety of acupuncture billing services, massage therapy billing services, and chiropractic billing services, including:

- Online insurance verifications

- EHR and SOAP documentation

- Insurance claims processing

- Insurance credentialing

Your holistic practice exists to deliver quality care to your patients—and somebody has to pay for that quality care. Your patients might not exactly know their role or responsibility in paying for the services rendered—for example, there could be assumptions about insurance coverage that doesn’t apply to your holistic practice—which can lead to friction later down the line.

That’s where a patient financial agreement can help your holistic practice improve the patient-payer-practice relationship and start the conversation about patient responsibility! Keep reading to learn more.

What Is Involved in a Patient Financial Agreement?

A patient financial agreement can contain a multitude of components depending on how extensive your practice’s policies are and what best suits your patients. For example, if any of your clients pay by check, then you’ll want to outline if there are any special fees or steps in the event a check has trouble processing.

For the most part, your holistic practice will want to include the following core components when drafting your patient financial agreement:

Be Clear About Insurance/Medicare Coverage

The chances are that your holistic practice doesn’t provide healthcare that is covered by insurance—and while there are important legislative initiatives that would expand Medicare’s coverage of holistic treatments, such rulings are not in place as of yet.

Make sure you clearly explain if your practice doesn’t take any insurance coverage or provide details if you do happen to be contracted with a third-party payer. While your patients should ideally be informed of what their insurance coverage includes, many of them might have a blind spot when it comes to coverage for holistic treatments.

Clarify the Patient Is Responsible as the Payer

Since your practice likely doesn’t take insurance, make sure it’s clear on the financial agreement that your patient is responsible for the financial aspect of services rendered. In the case that you do accept insurance, remind the patient that they’re responsible for paying their deductible before coverage starts. The patient is also responsible for any unpaid balances.

Clarifying the patient’s financial role in your holistic practice can contribute to patient engagement and help them realize what responsibility they have in their relationship with your holistic practice.

Outline Payment Options

Does your practice take cash only? Credit cards? Venmo? Briefly state what options your patients have for paying their balance, whether that’s at the time of checking in, checking out, or via an online payment portal.

Encourage Questions

Seeing the words FINANCIAL AGREEMENT might be intimidating to patients and seem like a formal legal document; while you don’t want to minimize the importance of the patient understanding their financial responsibility, you also don’t want to keep the process opaque.

Encourage questions both when you hand the agreement to your patient and consider adding a point of asking questions in the preface of the agreement. Keeping the lines of patient communication open can help your practice fortify the patient-practice relationship and boost patient engagement, which is always a good thing.

Why Is a Patient Financial Agreement Helpful To Your Holistic Practice?

While your patients no doubt understand that they need to pay for the care your holistic practice provides them, there might be some confusion about how that happens. Especially for new patients, a patient financial agreement can simply function to clarify or reiterate your practice’s policies, any potential fees for no-show appointments or bounced checks, and if your practice has any relationships with insurance providers or Medicare.

The patient financial agreement is also a great prompt for your patients to ask any questions about paying for your services. Starting this conversation can further build rapport and trust with your patients, which is crucial for patient engagement and patient satisfaction!

Patient Financial Agreement Template

Your holistic practice’s patient financial agreement can take whatever form you wish; it might be shorter or longer depending on how in-depth you want to be on your agreement. You might include your practice’s mission statement or other branding or contact information in the header, which can also take up space.

The following template is simply an example of what you could include; tailor it to best suit your holistic practice’s needs!

Thank you for choosing [Name of holistic practice] for your holistic wellness needs. We’re committed to providing you with quality care. We ask all clients to review and sign this policy, asking questions as necessary. A copy will be provided to each client upon request.

- Patient payment: The patient is responsible for payment at the time of service unless XYZ [if applicable].

- Payment methods: Explain if you take credit card payments, cash, checks, etc. Include any relevant fees that might incur if payment doesn’t go through, such as a service fee for bounced checks, etc.

- Proof of payment and photo ID required: Some practices might want to keep a photocopy of the patient’s ID on file

- No-show fees: Outline your practice’s no-show policy here

- Insurance/Medicare Programs: Some holistic practices and their specialties are accepted by third-party payers; outline those guidelines here or explain that you don’t accept any insurance or CMS patients. In this latter case, reiterate that the patient is responsible for payment.

I have read the above financial policies and agree to follow [Name of holistic practice’s] policies and I acknowledge my financial responsibility for services rendered.

Patient Name

Patient Signature

Date

Spend More Time with Patients by Partnering with Holistic Billing Services!

The overall healthcare revenue cycle can be incredibly complex and lead to a lot of stress. If your holistic practice wants to spend less time dealing with medical coding, billing, and trying to keep up with new regulations, then partner with Holistic Billing Services and spend more time on what matters most: your patients!

Our experts have decades of experience and expertise in your specialty. We’re eager to help you succeed!

Your holistic practice’s success and longevity within your community are predicated upon a streamlined healthcare revenue cycle—part of that comes from understanding a couple of key financial metrics that you can use to evaluate your practice’s current performance! Being able to calculate and track the financial key performance indicators, known as KPIs, of your holistic practice means that you’ll be able to make changes where needed and be better informed of your business’s status.

Two key metrics to track are the gross collection ratio (GCR) and the net collection ratio (NCR); these might sound the same, but they track different aspects of your practice. Both are valuable for you to know and measure because they help fill in the picture of your practice’s financial health!

Keep reading to learn the difference between gross and net collection ratios, plus how to calculate them for yourself.

What Is Your Gross Collection Ratio?

Let’s start with the GCR: the gross collection ratio refers to your practice’s gross income or gross profit; this is the most simple measure of your practice’s profitability. This metric includes the direct cost of producing or providing goods and services but doesn’t include the costs related to running your practice like administrative expenses, taxes, and other potential expenses.

An important note regarding the gross collection ratio is that it doesn’t deduct write-offs, so it’s considered to be a less effective measure of the financial performance of your holistic practice compared to the net collection ratio. Without removing write-offs, refunds, and contractual or non-contractual amounts from the math, you can’t get a comprehensive insight into your practice’s income.

What Is Your Net Collection Ratio?

On the other hand, your practice’s net collection ratio is an essential metric that measures how effectively your practice is at collecting all legitimate forms of revenue. This rate indicates inefficiencies in the process; for example, if a practice is struggling to collect payment due to bad debt, late filings, coding inaccuracies, claim underpayments or some other type of revenue issue, then it will have a low net collection rate.

The ideal net collection rate to strive for is 90% or above since that reflects your practice is collecting on all forms of revenue that it should be; great! However, if you find that your holistic practice’s NCR is below 90% then it might be wise to perform an internal audit of your billing practices.

Why Are These Financial KPIs Important?

These financial KPIs are important to your holistic practice’s success because they both provide visibility into how your practice is actually performing in relation to how it should be performing after factoring in any refunds, write-offs, or contractual and non-contractual amounts.

You can’t know what to improve about your practice’s financial standing if you’re not sure how well you’re doing in the first place; knowledge is power, after all! Streamlining your net collection rate can reveal areas within your medical billing and coding processes that might need some more attention and therefore result in an improved overall healthcare revenue cycle that benefits your practice.

How to Calculate Your GCR

Let’s take a look at how to actually calculate your practice’s gross collection ratio; the GCR formula looks like this:

Gross Collection Rate = Total Payments / Charges *100% (for a specific time period)

The gross collection rate only shows what your practice is allowed to collect. For example, you may have charged $200 but you only collected $175 from your insurance payer due to the agreement or contract that you might have signed.

Following this logic, the $175 is below the gross rate.

How to Calculate Your NCR

Since the net collection rate is one of the most important financial metrics to track for your holistic practice, it’s important that you calculate it with frequency—typically about once a quarter is a good measure of your practice’s financial performance.

A low NCR should be seen as an urgent priority since that directly affects the financial standing of your business. Optimizing your net collection rate starts with understanding how to assess your net collection rate. Calculating the net collection rate involves several important steps:

- Identify the time period that you want to monitor (e.g., 90 or 120 days). Assess data from an earlier period in which the majority of claims would be closed and cleared; ~6 months back is advisable.

- Calculate total payments (from payers and patients) for the designated time period.

- Calculate total charges minus approved write-offs (e.g., due to contractual reasons, bad debt, professional courtesy discounts, etc.) for the designated time period.

- Divide your calculation in step 2 by your calculation in step 3. Then multiply by 100.

In the end, the formula looks something like this:

Net Collection Rate = (Payments / (Charges – Contractual Adjustments)) * 100%

Do this consistently (e.g., every 90 days) for a period of at least one year to get the most accurate average rate.

Once you determine how your baseline collection rate stacks up to that goal, use information from the holistic industry to compare it to industry averages. From there, set a collections metric objective based on how much you would like to see it go up and how this could affect your revenue stream.

Let Holistic Billing Services Handle Your Healthcare Revenue Cycle!

If your holistic practice is overwhelmed by the billing and coding processes, then turn to the experts at Holistic Billing Services to handle your healthcare revenue cycle! Our experts have experience in your specialty and we’re eager to help you thrive. Medical billing and coding is a complicated process that seems to change all the time with new regulations—let our team take that stress out of your daily workflow so you can focus on what matters most: delivering great care to your patients.